- Get link

- X

- Other Apps

Why Do Businesses Filing for a New York State Certificate of Authority. Doing business in New York without having this certificate can result in fines or other penalties.

Obtain New York Certified Copies Harbor Compliance

Obtain New York Certified Copies Harbor Compliance

New York State Department of Health 875 Central Avenue Albany NY.

New york state certificate of authority. Register with the Tax Department and obtain a Certificate of Authority. The following security code is necessary to prevent unauthorized use of this web site. Note the Certificate of Authority were referring to is also known as a PLS709 not a Certificate of Authority to collect sales tax.

A Certificate of Authority is a document issued by the New York State Education Department Office of the Professions which indicates their approval for a new professional service provider to open a PLLC or PC. You may also need the certificate of authority to register for other business licenses and to register with banks and vendors. In New York State the Certificate of Authority also known as the Certificate of Authority to Collect Sales Tax is the Sales Tax ID number the state requires a business to use when collecting sales tax.

An out-of-state Limited Liability Company can register for a Certificate of Authority in New York State. If your corporation is a professional corporation in New York a Certificate of Good Standing from the appropriate Appellate Division or a Certificate of Authority Form PLS709 under seal from the New York State Department of Education Division of Professional Licensing Services Corporations Unit 89 Washington Avenue 2nd Floor Albany NY 12234 must be submitted with the Application for Authority. Requests for a Sales Tax ID number must go through the New York State NYS Department of Taxation and Finance.

This permit is also known as a wholesale license a resale license a sales permit and a resale certificate. If you are using a screen reading program select listen to have the number announced. Operating without a certificate of authority may result in penalties or fines.

Certificate of Surrender of Authority Foreign Limited Partnerships A foreign authorized limited partnership which will remain in existence in its home state may surrender its authority to. Register with the Tax Department and obtain a Sales Tax Certificate of Authority and resale certificate. This presence can include.

Most of these rules apply to businesses with a physical presence in New York State. Businesses that sell tangible personal property or taxable services in New York State need a Certificate of Authority. Generally the seller collects the tax from the purchaser and remits it to New York State.

NYS sales tax Certificate of Authority DTF-17. NYS Certificate of Authority DTF-17. Businesses that are incorporated in another state will typically apply for a New York certificate of authority.

Applicable the date of incorporation stated in the Certificate of Existence Certificate of Good Standing or Certificate of Status. Companies register with the New York State Department of State NYSDOS. All business entities that make taxable sales in New York State must register with the NY Department of Taxation and Finance and acquire a Certificate of Authority to collect sales tax.

Get Certificate of Authority Starting at 6995. The certificate of authority eliminates the need to incorporate a new business entity instead establishing the company as a foreign entity in New York state. The certificate allows a business to collect sales tax on taxable sales.

The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates. Certificate of Authority to collect New York State sales and use taxes. 12206 Prior to the issuance of a Certificate of Operating Authority the ALS-FR or ambulance service must complete and submit the following to the appropriate DOH EMS Regional Office.

Attach the consent of the NYS Tax Commission if required. The certificate comes from the New York State Department of Taxation and Finance DTF. Businesses should consult with an attorney to learn more about legal structures.

The Application for Authority must be signed by an officer director or duly authorized person. Generally the seller collects the tax from the. You are considered a vendor and must register with the Tax Department if you sell tangible personal property or taxable services such as personal property repairmaintenance and meet any of these conditions.

To request consent call the NYS Department of. The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates. If you will be making sales in New York State that are subject to sales tax you must register with the Tax Department and obtain a Certificate of Authority online at New York Business Express.

A Certificate of Authority is required for any business selling tangible goods in New York. Businesses will need to provide proof of registration in their home state or country. This registration renewal is authorized pursuant to The Omnibus Tax Equity and Enforcement Act of 1985 and will affect those vendors who have had their Certificate of Authority for three years or longer.

Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity.

21st Century Digital Ny State Certificate Of Authority

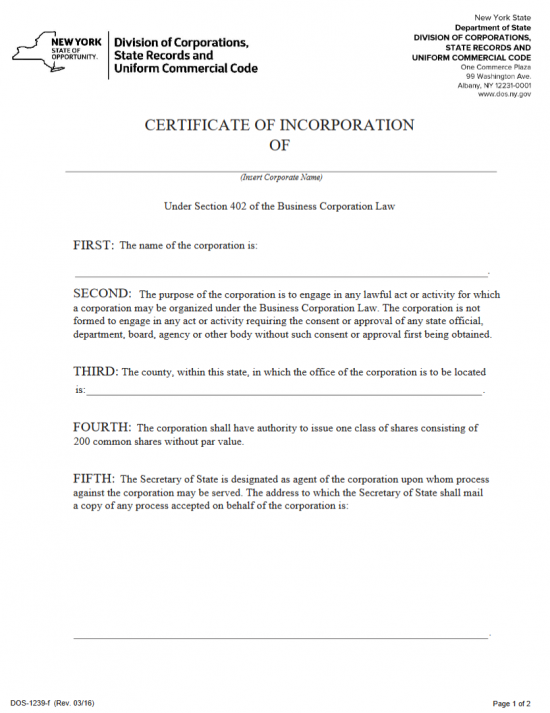

Free New York Certificate Of Incorporation Business Corporation Form Dos 1239 F

Free New York Certificate Of Incorporation Business Corporation Form Dos 1239 F

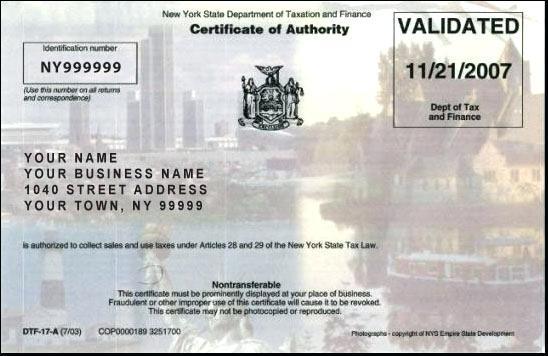

Free Certificate Of Authority Sample Template Example

Free Certificate Of Authority Sample Template Example

New York Atap Certificate Sample Seller Server Classes

New York Atap Certificate Sample Seller Server Classes

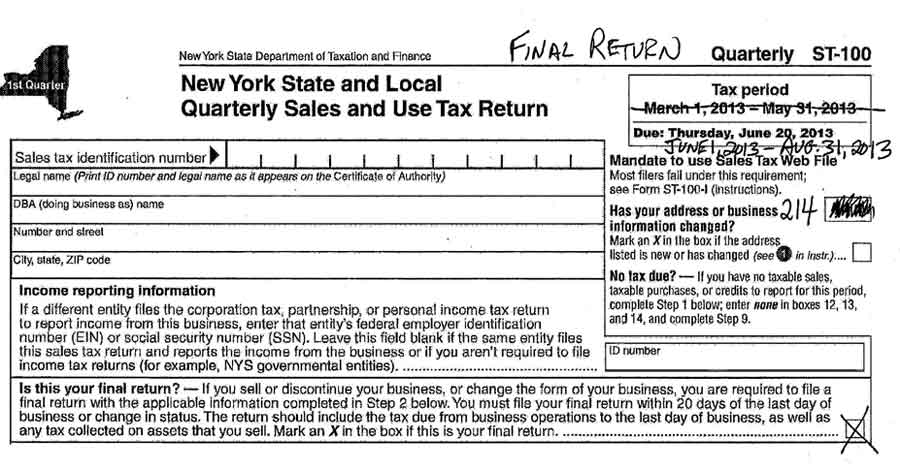

Filing A Final Sales Tax Return

Filing A Final Sales Tax Return

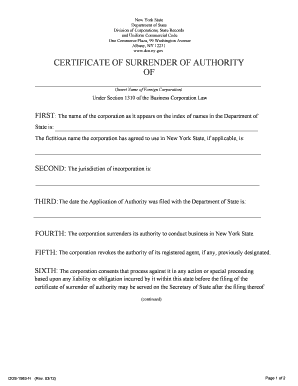

Fillable Online Dos Ny Certificate Of Surrender Of Authority Of New York State Department Of Dos Ny Fax Email Print Pdffiller

Fillable Online Dos Ny Certificate Of Surrender Of Authority Of New York State Department Of Dos Ny Fax Email Print Pdffiller

Http Chateaulamercatering Com Files Uploaded 112829 1d2d11 Retail 20cert Pdf

Restaurant Total Services Design Your Consultant In All Of Your Business Needs To Comply With The Nyc Enforcement Agencies

New York Certificate Of Authority Foreign New York Corporation

New York Seller S Permit Ny Business Tax Permit Fast Filings

New York Seller S Permit Ny Business Tax Permit Fast Filings

Https Www Victoriantradingwholesale Com Pdf Ny 20taxforms Pdf

Ny Business Owners Pay 50 Now Or Be Sut Down By Sales Tax Authority

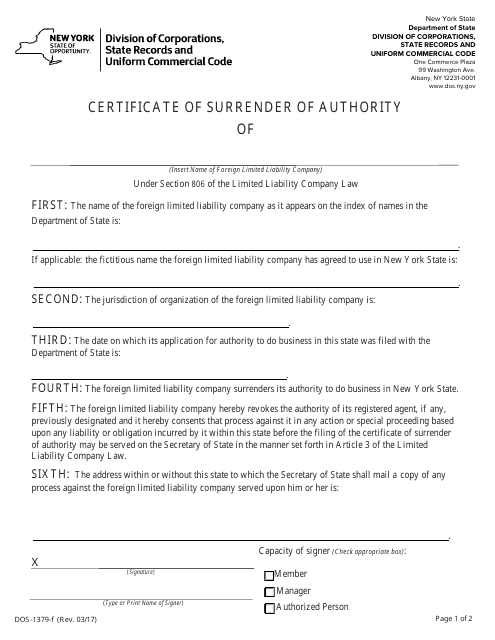

Form Dos 1379 F Download Fillable Pdf Or Fill Online Certificate Of Surrender Of Authority New York Templateroller

Form Dos 1379 F Download Fillable Pdf Or Fill Online Certificate Of Surrender Of Authority New York Templateroller

Http Documents Dps Ny Gov Public Common Viewdoc Aspx Docrefid 4f07c4a5 D280 4a6a 9cba F2f7adefcab3

Comments

Post a Comment