- Get link

- X

- Other Apps

Taylor led the overall capital raise for four private equity real estate investment funds which invested in a total of 478 million in transactions 4360 multifamily units and over 1 million commercial square feet. PERE tracks how the relationship between investment managers and investors drives equity capital into private real estate.

Comparing Listed Reits With Private Equity Real Estate What The Cambridge Associates Data Have To Say Nareit

Private Equity Real Estate Funds.

Private equity real estate funds. Private equity real estate funds allow high-net-worth individuals HWNIs and institutions such as endowments and pension funds to invest in equity and debt holdings related to real estate assets. Catalus Growth Partners a buyout fund focused on. 1 day agoSome of the largest pension funds and private equity firms are once again gearing up to invest in commercial real estate.

During his tenure Mr. In 2020 they together raised 1963 billion of discretionary equity over the past five years or just shy of 40 percent of the aggregate 4945 billion amassed by all 100 managers. Real estate private equity funds REPE Funds are structured as close-ended capital drawdown funds.

We also leverage thousands of sources every day including regulatory filings press releases news and websites. Through the first half of 2007 PERE funds continued to expand in terms of their number and average size. At the largest and most complex end of the spectrum are non-traded and traded.

Members 577 results Catalus Capital Private Equity Firm. Dallas real estate private equity firm closes on 325M fifth fund. 240 Investments Acquired Since Inception 21 BN.

Real estate private equity fund which is the subject of this white paper. We achieve reduced risk through a unique pre-development investment strategy and. Below are the ten largest private real estate funds in market by target size.

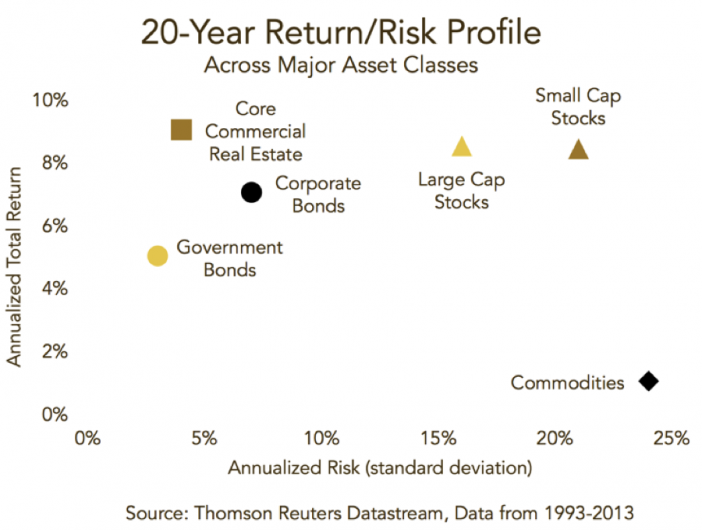

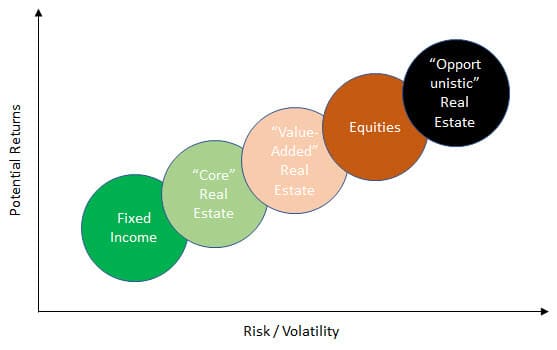

Private Equity A leading global manager and advisor of alternative assets Bainbridge Investments is comprised of investment funds that focus on international leveraged buyouts structured equity investments mezzanine investments real estate investments venture capital growth capital investments and investments in other private equity funds. Between March and May 2020 commercial real estate. The most high profile types of real estate private equity fund strategies are called Opportunistic or Value-Add and refer to higher riskreturn types of investments than the more conservative Core or Core-Plus strategies.

Private real estate investment funds are professionally managed funds that invest directly in real. Catalus Capital is a multi-strategy private equity firm founded in early 2011. Real estate investment firm heavily involved in The Domain closes on 325M fifth fund.

Titan Development Real Estate Fund I TDREF I is a private equity real estate fund that prioritizes asset diversity in secondarytertiary markets where competition is limited and markets are under-served. An Institutional Perspective by Andre Kuzmicki and Daniel Simunac Introduction The importance of private equity real estate PERE funds has been growing dramatically in recent years. Private equity real estate is a type of investment that involves the acquisition financing and ownership of properties via pooled funds from many investors.

Stonelake V Final Close Press Release. Surging Austin office market hits record high for rents. A private real estate fund is a pooled investment fund structure intended for the acquisition of multiple properties in a blind pool.

Taylor is a licensed North Carolina Real Estate Broker and holds two securities licenses Series 7 and. Alternatively to access a full list of the current private real estate funds in market click on the button. The firm invests out of two strategies.

Real estate mutual funds can be open- or closed-end and either actively or passively managed. In addition we actively manage 19 billion of gross asset value across three opportunistic real estate private equity fundswith original capital commitments of 72 billion. However private real estates higher returning strategies value-add and opportunistic.

A global real estate database thats both wide-ranging and in-depth. We have seen multiple REPE funds structured and operated in our career and while the detailed terms will change as the market changes. In the image below you can see the.

Unsurpassed private real estate coverage encompassing investors funds fund performance fund terms assets deals exits service providers and much more. Gross Asset Value Acquired with Partners Since Inception. Real Estate Private Equity Firms.

To view more data on each one click on the individual fund name or fund manager in the table below. The flexibility of the firms investment mandates sets it apart from its peers.

Why Reits Beat Private Equity Real Estate Funds Seeking Alpha

Why Reits Beat Private Equity Real Estate Funds Seeking Alpha

Amazon Com Investing In Real Estate Private Equity An Insider S Guide To Real Estate Partnerships Funds Joint Ventures Crowdfunding Ebook Cook Sean Kindle Store

Amazon Com Investing In Real Estate Private Equity An Insider S Guide To Real Estate Partnerships Funds Joint Ventures Crowdfunding Ebook Cook Sean Kindle Store

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep

Term Of The Week Private Equity Real Estate Youtube

Term Of The Week Private Equity Real Estate Youtube

Private Equity Real Estate Funds Chasing Smaller Deals Portfolios

Private Equity Real Estate Funds Chasing Smaller Deals Portfolios

In Plain English The Real Estate Private Equity Fund Profit Sharing Catch Up Mechanism Real Estate Financial Modeling

In Plain English The Real Estate Private Equity Fund Profit Sharing Catch Up Mechanism Real Estate Financial Modeling

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep

Private Equity Real Estate Funds Chasing Smaller Deals Portfolios

Private Equity Real Estate Funds Chasing Smaller Deals Portfolios

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep

Private Equity Real Estate Funds In Turkey Finance And Banking Turkey

Private Equity Real Estate Funds In Turkey Finance And Banking Turkey

Real Estate Private Equity Overview Careers Salaries Interviews

Real Estate Private Equity Overview Careers Salaries Interviews

Private Equity And Real Estate Fund Administration Global Advisory Administration Family Office Firm Maitland Group

Private Equity And Real Estate Fund Administration Global Advisory Administration Family Office Firm Maitland Group

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Comments

Post a Comment