- Get link

- X

- Other Apps

Pay the amount you owe by May 17 to avoid penalties and interest. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension.

Corona Virus Tax Deadline Extension 2020 Youtube

Corona Virus Tax Deadline Extension 2020 Youtube

2020 Tax-exempt organization returns normally due May 17.

2020 tax extension deadline. The extension also applies to. American expats have to file US taxes the same as Americans who live in the states reporting their worldwide income. But in 2020 the IRS pushed back the federal tax deadline to July 15 due to the coronavirus.

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15 2021 to May 17 2021. 2020 business and personal tax returns due April 15. The IRS will be providing formal guidance in the coming days.

April 15 2021 May 17 2021 will be the postponed tax deadline or Tax Day for 2020 Tax Returns. This follows a previous announcement from the IRS on March 17 that the federal income tax filing due date for individuals for the 2020 tax year was extended from April 15 2021 to May 17 2021. The IRS tax deadline to file your tax return has been extended to Monday May 17 2021 from the typical deadline of April 15.

The deadline is October 15 2021. The latest 2020 Tax Return deadlines are listed here for the 2020 return due in 2021. The three-month extension will automatically apply to calendar year filing individuals inclusive of the self-employed trusts and estates as.

This is because the US taxes based on citizenship not on residence like most other countries. 2020 IRA contributions due April 15. Start to prepare and eFile your 2020 Tax Return s.

The IRS announced it is extending the 2020 tax year federal tax filing due date for individuals only from April 15 2021 to May 17 2021. How Will the Tax Deadline Extension Affect Taxpayers. Many US expats assume that a tax treaty paying foreign taxes or only.

Notice 2021-21 PDF provides details on the additional tax deadlines which have been postponed until May 17. This relief applies to all individual returns trusts and corporations. The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15 2020 are automatically extended until July 15 2020.

This extension does not apply to business tax returns or estimated payments. Will California also postpone the 2020 tax year due date for individual California taxpayers. Filing this form gives you until Oct.

See detailed state related tax deadline and payment information. If you decide to extend your tax filing to a later date youll need to file the extension no later than May 17 the tax deadline. A number of state tax deadlines were also extended to match.

Whether youre filing as an individual a business a trust an estate or anything else your 2020 tax year federal tax filing and payment deadline is now May 17. New Mexico has extended the deadline for filing and paying 2020 New Mexico Personal Income taxes to May 17 2021. In March the COVID-19 pandemic led the Treasury and IRS to delay when Americans are required to file their tax returns calling for an automatic tax deadline extension to July 15 2020 for your 2019 taxes.

You wont need to take. New York May 17 New York State has extended the due date for personal income tax returns and related payments for the 2020 tax year to May 172021. For 2020 a self-employed person can contribute up to 57000 to a Solo 401 k 63500 if he or she is age 50 or.

If they request a tax return filing extension the deadline shifts to October 15. Guide to 2020 IRS Deadlines and Extensions for US Expats. You cannot file your 2020 tax return by May 17 2021.

To get the extension you must estimate your tax liability on this form and should also pay any amount due. 2021 Quarterly estimated income tax payments due April 15. An extension to file your tax return is not an extension to pay.

15 to file a return. 2020 Tax Deadline Extension. When is the 2021 Tax Deadline for Filing for the 2020 Tax Year.

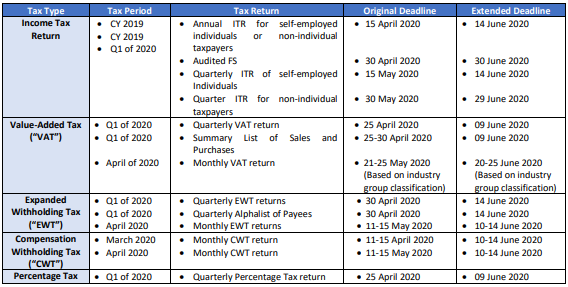

Federal tax filing extension for 2020 returns Normally you must file your tax return by April 15 aka Tax Day. And in 2021 the IRS is once. May 14 2020 For all ONETT transactions BIR Forms 1706 1707 1800 and 1606 if the tax due date falls within the Enhanced Quarantine Period these corresponding tax forms deadline will be extended for thirty 30 calendar days from its original due date.

Use Payment for Automatic Extension for Individuals FTB 3519 to make a payment by mail if both of the following apply. 2021 Quarterly payroll and excise tax returns normally due on April 30.

/income-tax-deadlines-2021-75aaceca6a8f47eabc8a17a9185f24ac.png) Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Extending The Tax Deadline For Covid 19 What It Means For You In 2020

Extending The Tax Deadline For Covid 19 What It Means For You In 2020

October Tax Deadline Nears For Extension Filers H R Block Newsroom

October Tax Deadline Nears For Extension Filers H R Block Newsroom

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Tax Extension Deadline 2020 How To File Thestreet

Tax Extension Deadline 2020 How To File Thestreet

2020 Tax Season Payment Deadline Extended To July 15 As Nation Fights Coronavirus Irs News Cpa Practice Advisor

2020 Tax Season Payment Deadline Extended To July 15 As Nation Fights Coronavirus Irs News Cpa Practice Advisor

Irs Tax Deadline Extended Paul Anderson Cpa

Irs Tax Deadline Extended Paul Anderson Cpa

Tax Extension Deadline File Your 2019 Return By October 15 To Avoid Penalties Kiplinger

Tax Extension Deadline File Your 2019 Return By October 15 To Avoid Penalties Kiplinger

Important Tax Filing And Extension Deadlines 2020

Important Tax Filing And Extension Deadlines 2020

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

2020 Tax Deadline Extension What You Need To Know Taxact

2020 Tax Deadline Extension What You Need To Know Taxact

Tax Season Update Payment Extended Filing Is Not Alloy Silverstein

Tax Season Update Payment Extended Filing Is Not Alloy Silverstein

Comments

Post a Comment