- Get link

- X

- Other Apps

And before you think Im picking on 401Ks it applies to Roth IRA and Traditional IRA fees as well. They often act as the plan administrator as well generating notices for your plan reporting etc.

12b 1 Fees What They Are And Why You Should Avoid Them

12b 1 Fees What They Are And Why You Should Avoid Them

Investment Fees on a 401 k If you have money in a 401 k then you are paying investment fees.

401k management fees. These administrative costs are most often paid for by the plan sponsor. At the high end those fees could cost you more than 150000 in. Typically 401 k plans have three types of fees.

If you continue with your current fee structure and accept the 750 return your 100000 401 k plan will grow to 875495 after 30 years. And those can be much harder to calculate and costly. 401 k plan fees can vary greatly depending on the size of your employers 401 k plan the number of participants and the plan provider.

The total expense ratio can cover the administrative fees operating expenses recordkeeping fees management fees and marketing 12b1 fees as well as all other investment fees and expenses. Some of these 401 k fees are charged at a plan level for the management and administration of a plan while others are related to the investments made by employees within the plan. These third-party providers are.

When you first go searching for your 401K plan fees it can be pretty frustrating. There are fees whether your money is in a money market fund bond fund or investment fund. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US.

Sometimes the fees paid in a 401 k are. In gaining a wider choice of investments for her retirement savings she offset that cost as her portfolio retained 3000 in value that would have been lost if she had stuck with her plans limited offerings. However this professional management comes at a price.

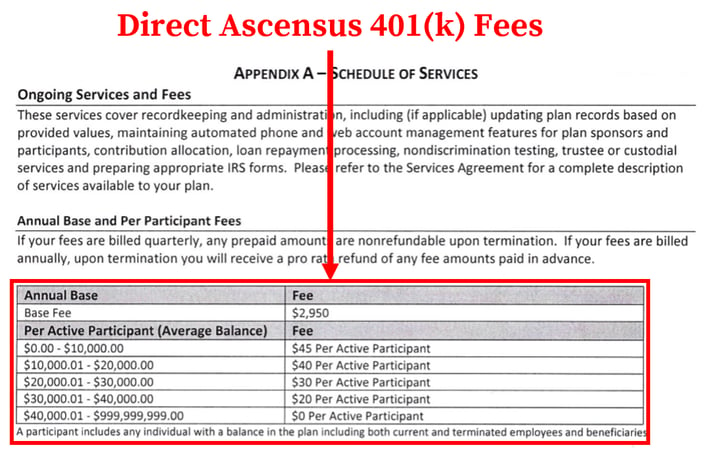

Insofar as 401 k management fees are concerned the recordkeeper will usually have a flat fee often called a base or platform fee coupled with a per participant fee. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

Behind the scenes investment managers are managing your 401 k funds to help maximize potential gains. Whether you pay an advisor or not youre paying fees on the financial products in your portfolio. Those charged by the 401k provider and those charged by the mutual funds or ETFs in the account.

Disbursement help free help. 401 k plan administrators have a lot on their plates. Average 401k Fees A recent study by the Center for American Progress CAP found that the typical American worker who earns a median salary starting at age 25 will pay about 138336 in 401k fees over their lifetime.

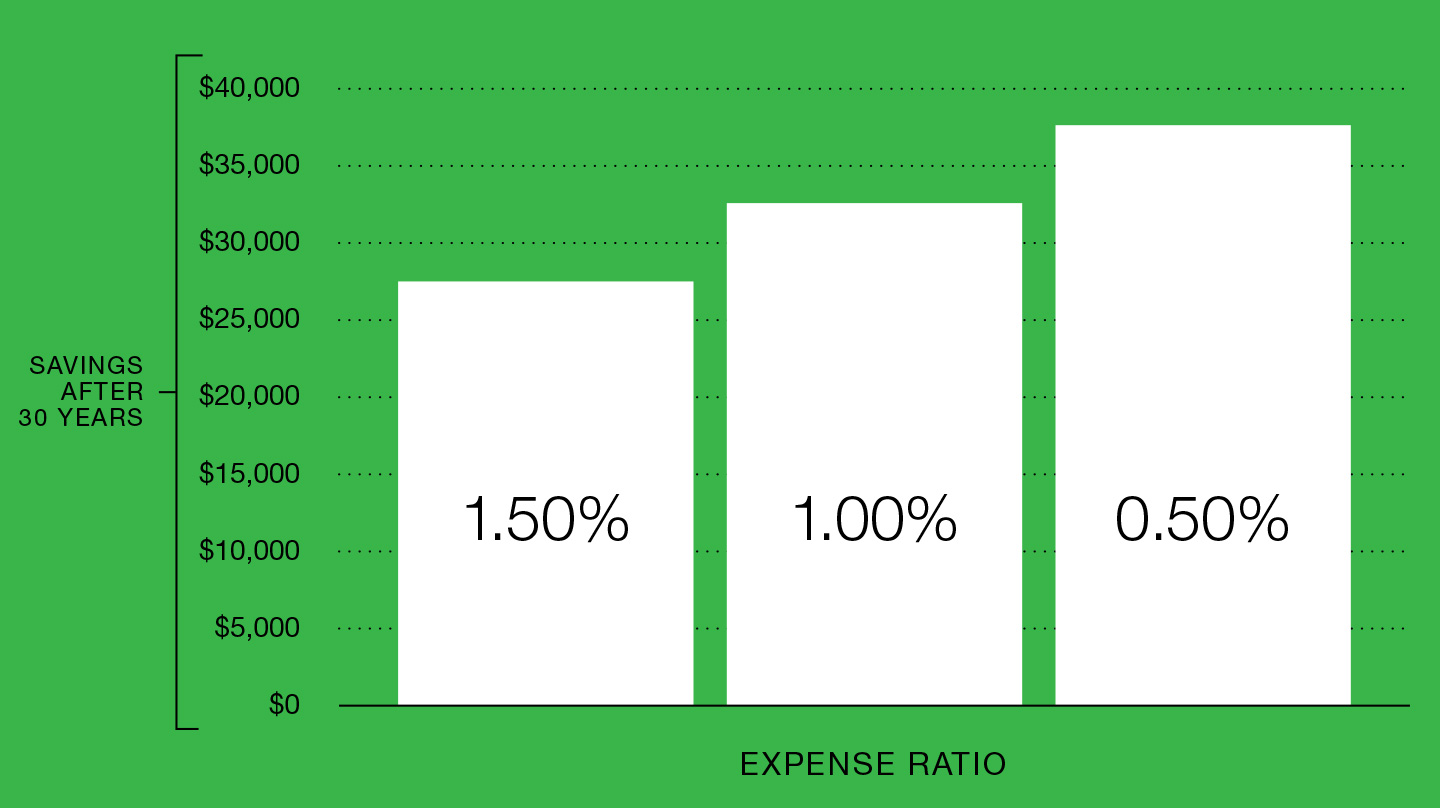

The biggest factors in the cost of your 401 k are the size of your company and the plan it uses David Blanchett head of retirement research for Morningstars Investment Management group tells. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. If you lower the annual fees by 050 and earn.

The Department of Labor divides 401 k fees into three categories. Investment fees administrative fees and fiduciary and consulting fees. There are two types of fees.

Its not like your 401K administrator or employer sends you a bill at the end of the year that says heres how much you owe us for managing your retirement. How to figure out what youre paying---and if youre paying too much. Alita Rosenfeld 60 doesnt mind paying 400 a year to maintain a brokerage window in her 401k plan.

Depending on the service provider and how much you have to invest a managed account can cost you 015 to 07 a year. A Guide to 401k Plan Fees and Expenses. Your 401 k expense ratio is the percentage of retirement fund assets that plan participants pay for their investments.

Disbursement help free help. Fees on your 401k can do a real number on your returns---and on your retirement. Your current 401 k balance is 100000 thats right in line with the average balance by age and you plan to contribute 10000 each yearabout half.

Fees Advance Capital Management 401k

Fees Advance Capital Management 401k

How To Find Calculate Ascensus 401 K Fees

How To Find Calculate Ascensus 401 K Fees

401 K Fees Everything You Need To Know Smartasset

401 K Fees Everything You Need To Know Smartasset

Who Are The Best 401 K Providers For Your Small Business

Who Are The Best 401 K Providers For Your Small Business

401 K Sponsors Focus On Benchmarking And Lowering Fees

401 K Sponsors Focus On Benchmarking And Lowering Fees

What You Need To Know About 401 K Fees Fisher 401k

What You Need To Know About 401 K Fees Fisher 401k

404 A 5 Participant Fee Disclosures Rules Requirements

404 A 5 Participant Fee Disclosures Rules Requirements

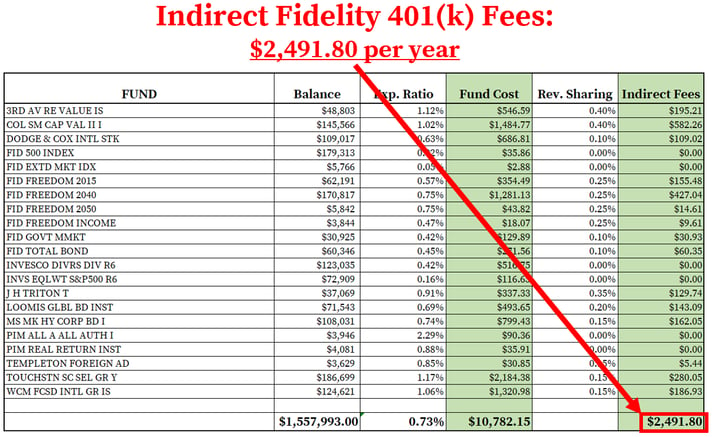

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

Fee Analyzer Mutual Fund Fee Calculator Personal Capital

Fee Analyzer Mutual Fund Fee Calculator Personal Capital

What Are Industry Average Fees For A Fiduciary Grade 401 K Financial Advisor Sapling Wealth

What Are Industry Average Fees For A Fiduciary Grade 401 K Financial Advisor Sapling Wealth

Fee Analyzer Mutual Fund Fee Calculator Personal Capital

Fee Analyzer Mutual Fund Fee Calculator Personal Capital

A Structured Approach To Understanding 401 K Fees And Disclosures Onebite

A Structured Approach To Understanding 401 K Fees And Disclosures Onebite

Infographic On 401k Plan Fees 401khelpcenter Com

Are 401 K Fees Eating Into Your Retirement Now Migh Ticker Tape

Are 401 K Fees Eating Into Your Retirement Now Migh Ticker Tape

Comments

Post a Comment