- Get link

- X

- Other Apps

238066 regulated by ASIC for the benefit of wholesale clients only. Nikkiso has acquired 2 companies including 1 in the last 5 years.

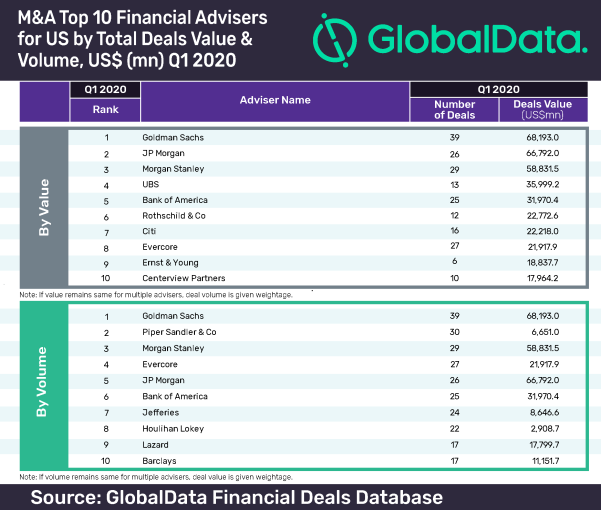

Goldman Sachs Is Top M A Financial Adviser In The Us In Q1 2020 Globaldata

Goldman Sachs Is Top M A Financial Adviser In The Us In Q1 2020 Globaldata

Some mergers and acquisitions have the capacity to decrease competition in various ways.

Jp morgan mergers and acquisitions deals. Morgan provides leveraged financing to companies to help them achieve objectives such as making an acquisition effecting a buy-out repurchasing shares or funding a one-time dividend or investment. A total of 1 acquisition came from private equity firms. This material is issued and distributed by JP.

Deals of the day- Mergers and acquisitions. Morgan Co Bank One Bear Stearns and Washington MutualGoing back further its predecessors include major banking firms among which are Chemical Bank Manufacturers Hanover First Chicago Bank National Bank of Detroit Texas. - Advised Fortune 500 technology and healthcare companies on strategic.

Morgan arranges leveraged loans high-yield or junk bonds and mezzanine debt for clients. Mergers in the financial industry have begun to heat up as established players have snapped up fintech upstarts. This time Wall Street is wildly enthusiastic while reaction to the earlier deal was lukewarm at best.

Strong equity and debt markets as well as swelling corporate cash coffers also helped boost the confidence of chief executives convincing them that now is as good a time as ever to pursue transformative mergers. Global mergers and acquisitions MA had their strongest start ever in the first quarter of 2018 totaling 12 trillion in value as US. Adds Hewlett Packard Enterprise JP.

Morgan led the bridge providing 13 billion of committed financing out of a total of 20 billion. Updates Respol CK Hutchison Holdings Sept 1 Reuters - The following bids mergers. Morgan Securities Australia Limited ABN 61 003 245 234 AFS Licence No.

The Companys most targeted sectors include business services 50 and energy services and equipment 50. Morgans global co-heads of mergers and acquisitions discuss key trends shaping the MA market this year. MA Action Perks Up.

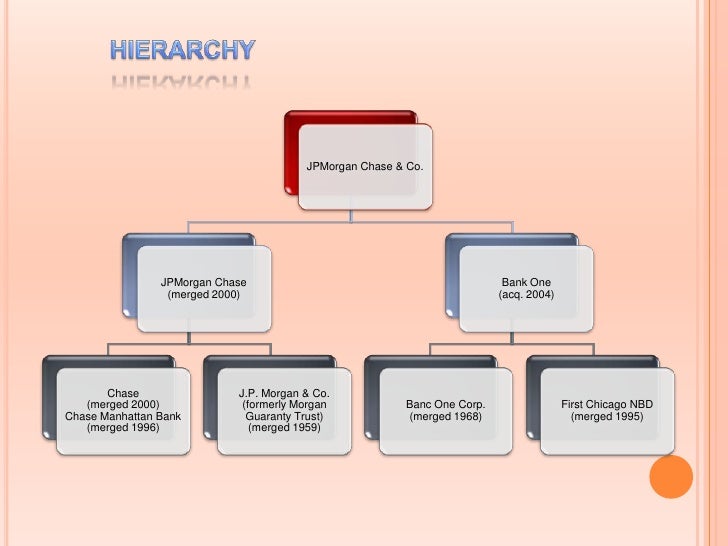

Banking companies since 1996 including Chase Manhattan Bank JP. Nikkiso has acquired in 1 US state and 2 countries. But theres a difference.

San Francisco Bay Area. Dimons comments come the week after rival bank Morgan Stanley announced a 13. S everal pharma and biotech companies participated in the prestigious JP.

Vice President Technology Mergers Acquisitions. Banking mega-mergers keep on coming. ON TAP FOR 2019 JP.

The year-end acceleration of mergers and acquisitions MA worldwide will. Meanwhile Citi led in the volume terms having advised on 10 deals worth 144bn. Surge In Year-End Global Dealmaking Will Keep MA Bankers Busy.

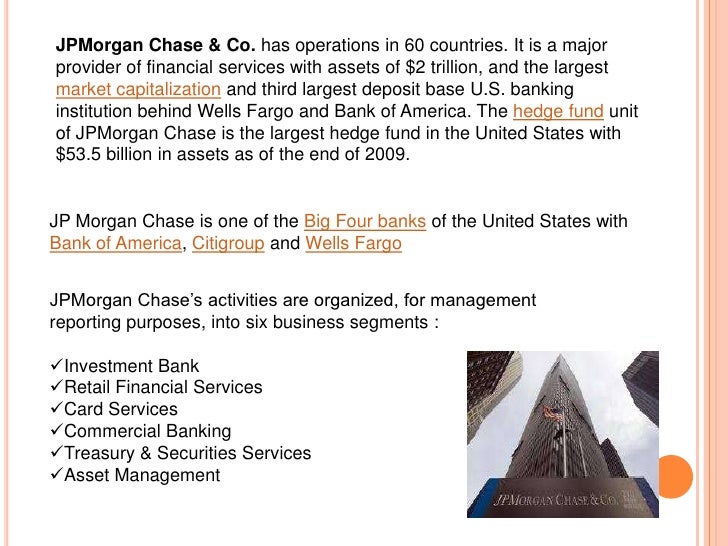

Join Mergr and gain access to Nikkisos MA summary the MA summaries of companies just like it as. JPMorgan Chase in its current structure is the result of the combination of several large US. The merger between JP Morgan Chase and Bank One presented JP Morgan C hase with the opportunity to expand its perspective through providing the firm with access to retail banking markets and clientele in the regions where its.

Morgan is familiar with such growth-driven MA deals. Chief Executive Officer Jamie Dimon told investors a year ago that the firm was aggressively looking at acquisitions across its business lines. Apr 28 2021 JP Morgan and Citi were the top mergers and acquisitions MA financial advisers in the oil gas sector for Q1 2021 by value and volume respectively.

Mergers Acquisitions Deals at JP. JP Morgan advised on six deals worth 198bn which was the highest value among all the advisers. Tax reform and faster economic growth in Europe unleashed many companies deal-making instincts.

Jan 13 2020 How will the volume of mergers and acquisitions in 2020 stack up against the previous year. Morgan Healthcare Conference held in San Francisco CA this week. Morgan Chase announced a 59 billion merger with Bank One just three months after Bank of America and FleetBoston said they would tie the knot.

Morgan health-care meeting signal busy MA year Lillys 8 billion purchase of Loxo Oncology is one of several announced at San Francisco event. The Year Ahead With markets expected to be more stable in 2010 fashion retail and beauty observers can expect more merger and acquisition activity. Jul 2012 - Present8 years 8 months.

Mark on JPMorgan-through a series of landmark deals-leading the firm for three decades-Like his father Jack embodied the same values-of honesty and integrity stating that-the idea of doing only first class business-and that in a first class way has been before our minds-And this concept is the way we do business today-In 1940 JP.

Outstanding At What She Does India Born Rakes In Billions For Jpmorgan Business Standard News

Outstanding At What She Does India Born Rakes In Billions For Jpmorgan Business Standard News

Deals At J P Morgan Health Care Meeting Signal Busy M A Year

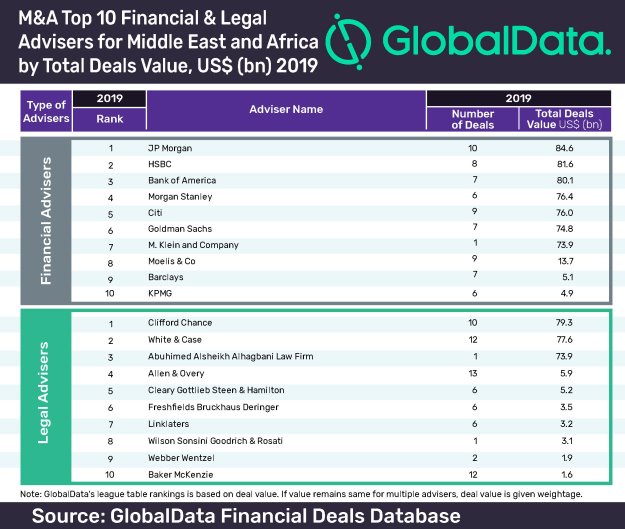

Jp Morgan Leads Globaldata S Top 10 Global M A Financial Advisers League Table In Middle East And Africa

Jp Morgan Leads Globaldata S Top 10 Global M A Financial Advisers League Table In Middle East And Africa

Morgan Stanley And Jp Morgan Were Top M A Financial Advisers By Value And Volume In Global Financial Services Sector For 2020 Globaldata

Morgan Stanley And Jp Morgan Were Top M A Financial Advisers By Value And Volume In Global Financial Services Sector For 2020 Globaldata

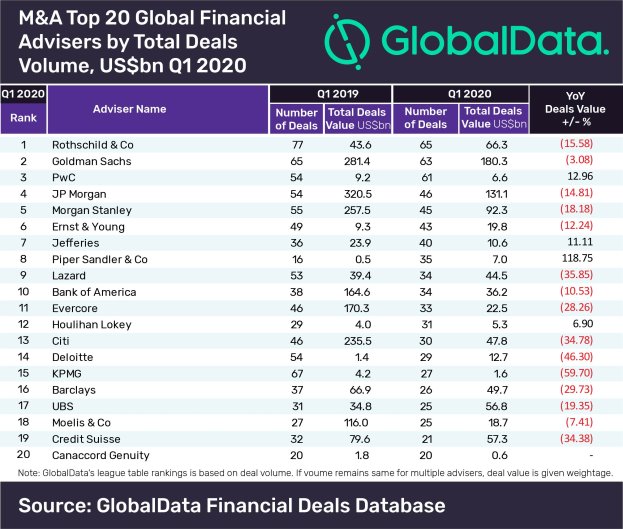

Top 20 Global M A Financial Advisers For Coronavirus Hit Q1 2020 Revealed Private Banker International

Top 20 Global M A Financial Advisers For Coronavirus Hit Q1 2020 Revealed Private Banker International

Jpmorgan Year End M A Will Keep Bankers Busy Pymnts Com

Jpmorgan Year End M A Will Keep Bankers Busy Pymnts Com

Goldman Sachs Was Top M A Financial Adviser By Value And Volume For Q1 Q3 2020 Globaldata

Goldman Sachs Was Top M A Financial Adviser By Value And Volume For Q1 Q3 2020 Globaldata

What Became Of My Bank Business History The American Business History Center

What Became Of My Bank Business History The American Business History Center

Jp Morgan Dominates Globaldata S Global M A Financial Adviser League Table In The Financial Services Sector For Fy2018 Globaldata

Jp Morgan Dominates Globaldata S Global M A Financial Adviser League Table In The Financial Services Sector For Fy2018 Globaldata

The Biggest Mergers And Acquisitions In Banking The Motley Fool

The Biggest Mergers And Acquisitions In Banking The Motley Fool

Jpmorgan Chase Jpmorgan Chase History Ceo And More

Jpmorgan Chase Jpmorgan Chase History Ceo And More

Jp Morgan Leads Globaldata S Top 20 Global M A Financial Adviser League Table For Q1 2019 Globaldata

Comments

Post a Comment