- Get link

- X

- Other Apps

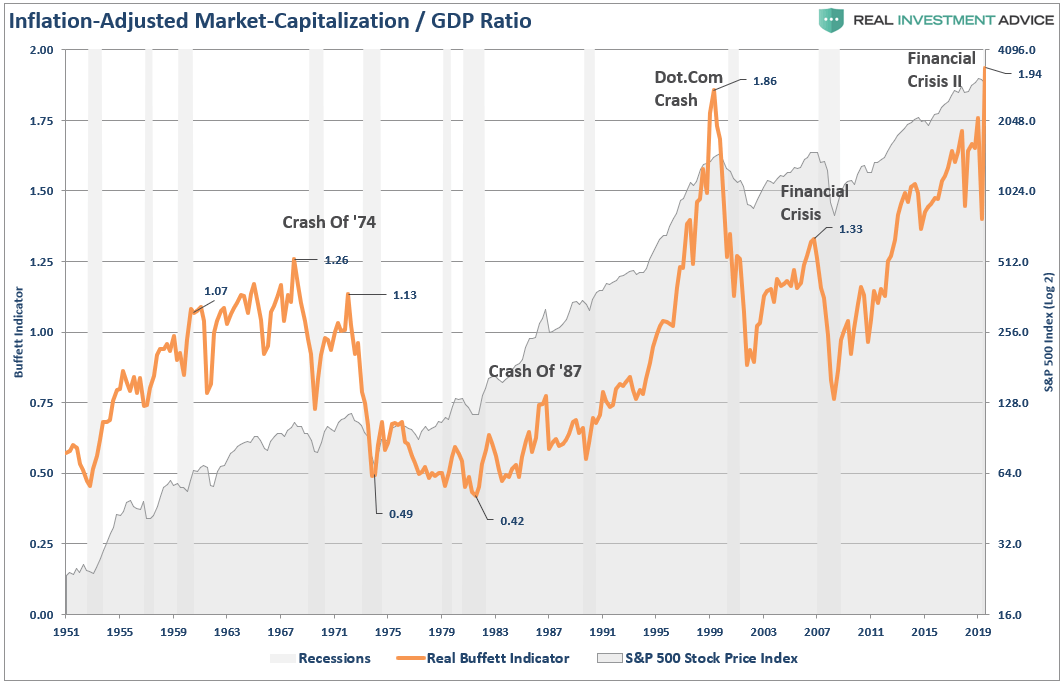

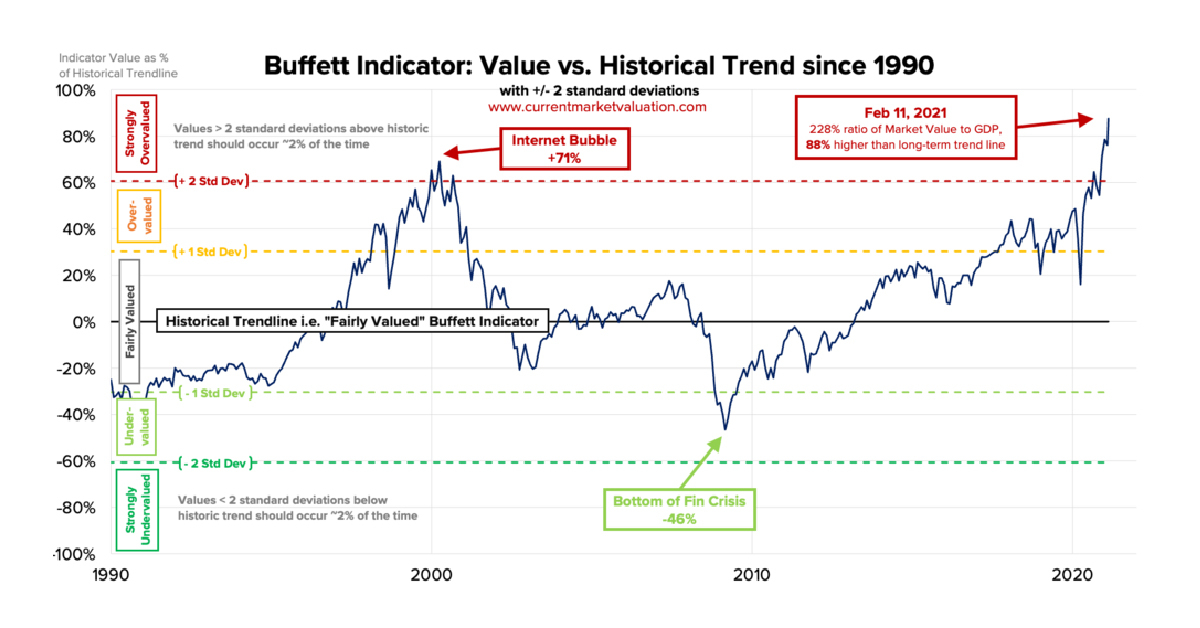

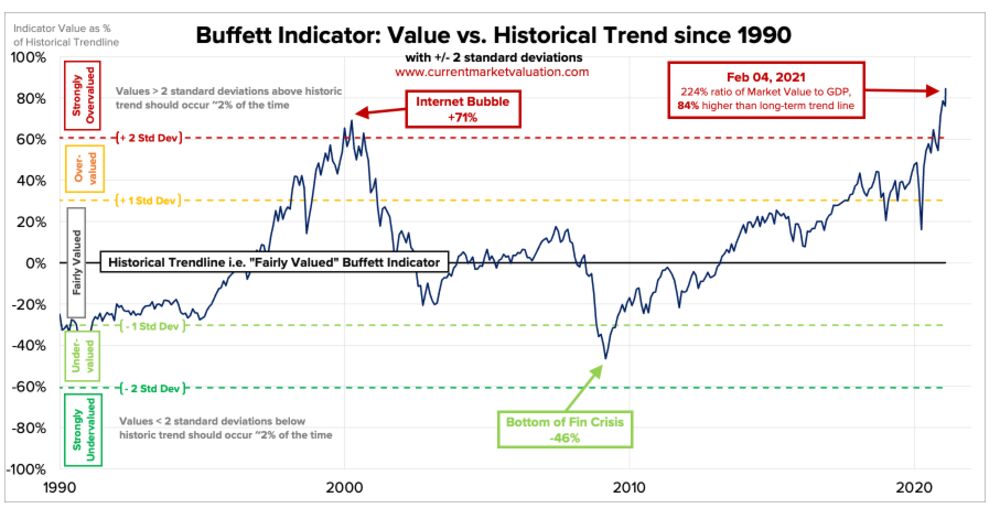

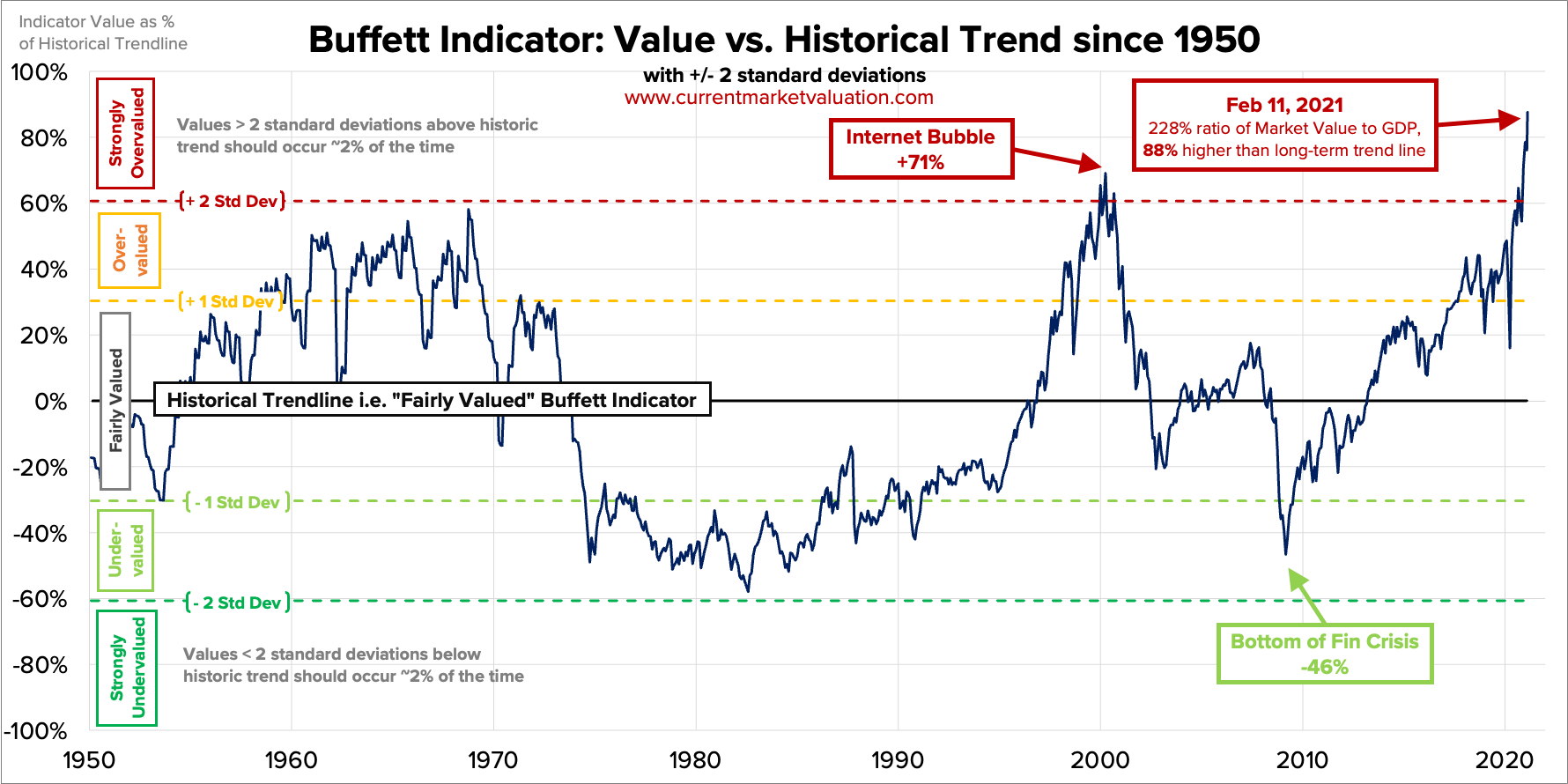

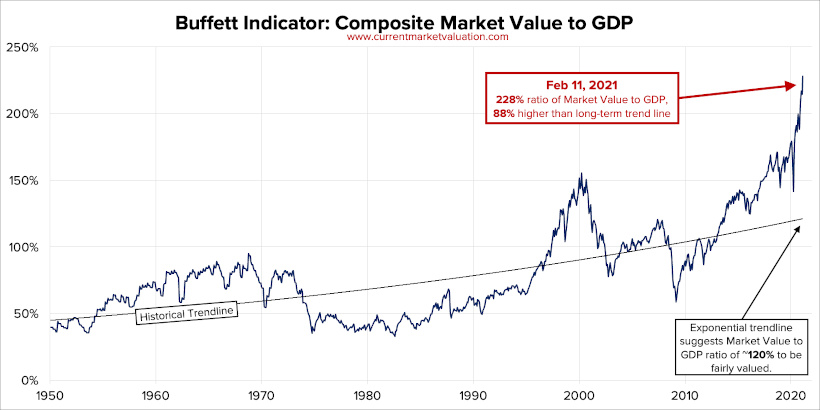

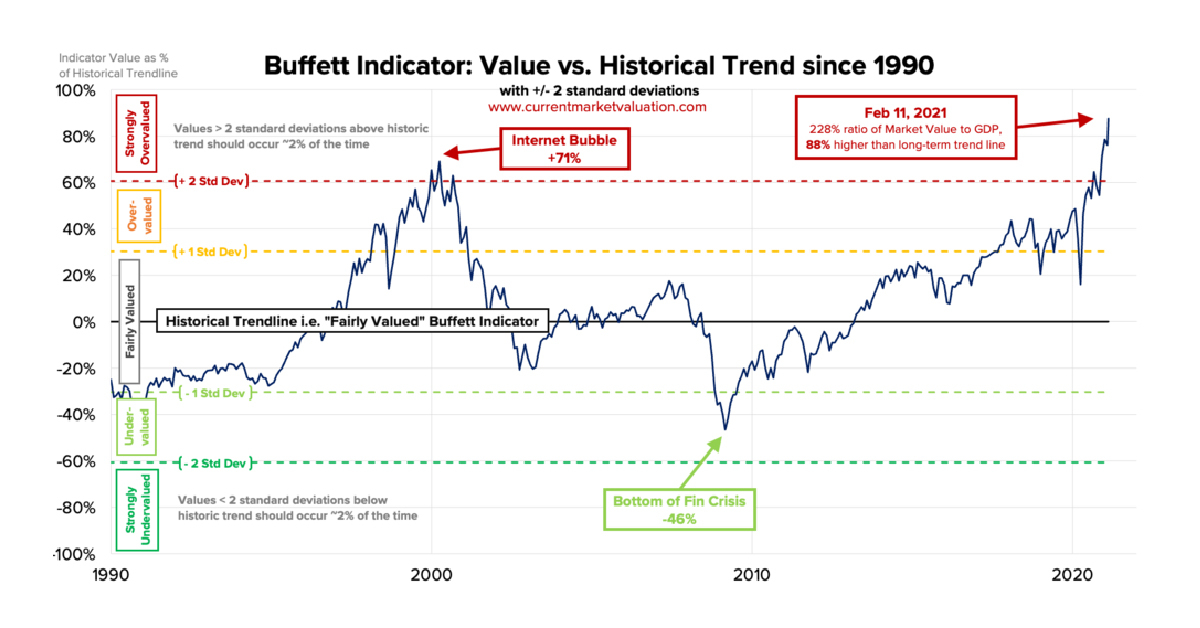

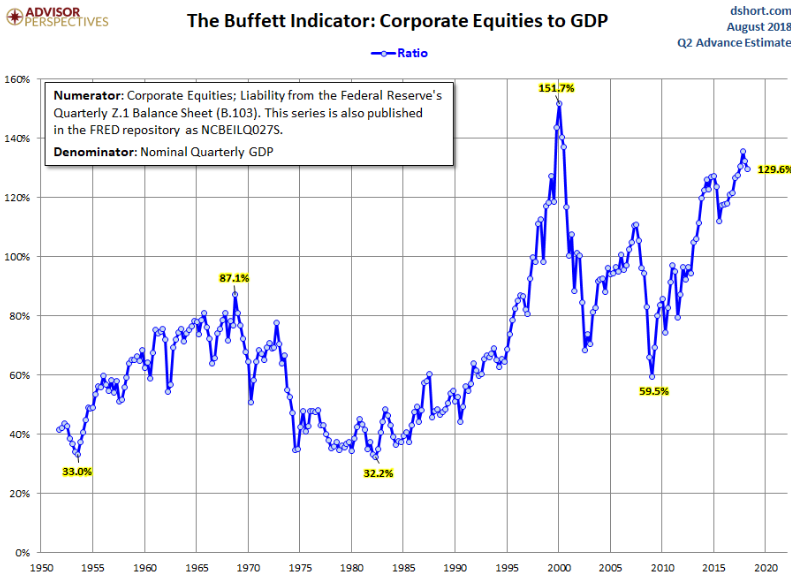

The worldwide Warren Buffett Indicator global market cap versus GDP is also at unprecedented heights recently hitting 123 breaking levels not seen since the dot-com bust. It measures the total US stock market capitalization divided by the total dollar value of the US Gross Domestic Product.

Buffett Indicator Why Investors Are Walking Into A Trap Seeking Alpha

Buffett Indicator Why Investors Are Walking Into A Trap Seeking Alpha

A high ratio indicates an overvalued marketand as of February 11.

Warren buffett indicator. The Buffett indicator divides the total value of publicly. Many outlets have been reporting on this including Fortune Bloomberg the Wall Street Journal Business. Has Warren Buffett Lost His Touch.

Named after Warren Buffett who called the ratio the best single measure of where valuations stand at any given moment. It was proposed as a metric by investor Warren Buffett in 2001 who called it probably the best single measure of where valuations stand at any given moment and its modern form compares the capitalization of the US Wilshire 5000 index. The Warren Buffett Indicator.

Market history and several decades ago Buffett described it as the best single measure of where valuations stand at. Buffett Indicator is alarmingly bearish and this years Berkshire shareholder letter could reveal why Last Updated. As pointed by Warren Buffett the percentage of total market cap TMC relative to the US GNP is probably the best single measure of where valuations stand at any given moment GuruFocus modified this measurement by adding the total asset of Federal Reserve Banks in the denominator arriving at another indicator for market valuation.

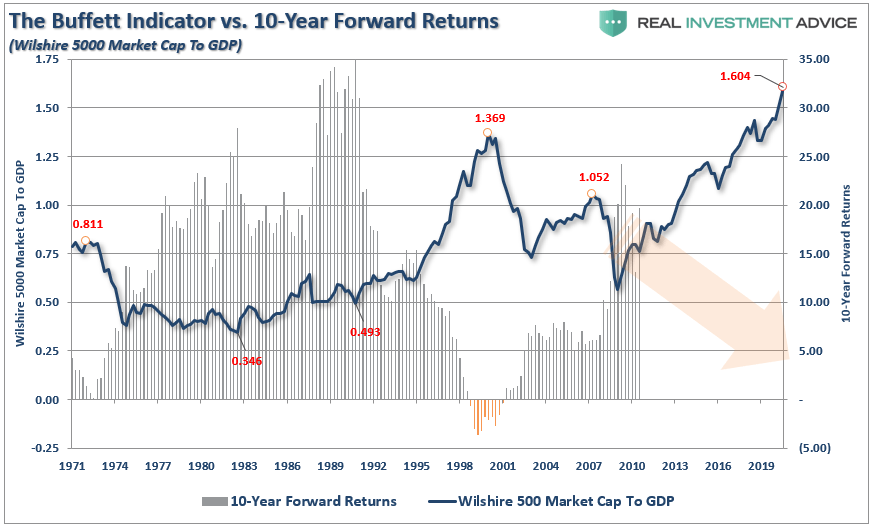

What is the Buffett Indicator. The Buffett indicator is a valuation multiple used to assess how expensive or cheap the aggregate stock market is at a given point in time. Lately the Buffett Indicator has been flashing a warning sign about the stock market.

Warren Buffetts preferred stock-market gauge hit a record high signaling that stocks are overvalued and that a crash could be coming. This indicator can be used to help decide whether to invest in a countrys stock market. In 2001 Warren Buffett famously described the stock market capitalization-to-GDP ratio as the best single measure of where valuations stand at any given moment.

Warren Buffett has called one specific measure probably the best single measure of where valuations stand at any given moment. FA Center Opinion. Buffetts Berkshire Hathaway corporation is now one of the largest firms on the planet.

Warren Buffetts Top Indicator Is Flashing RED. As pointed out by Warren Buffett the percentage of total market cap TMC relative to the US. Buffett himself called the metric the best single measure of where valuations stand at any given moment.

And this measure is the ratio of total market capitalization TMC to gross national product GNP. Buffetts Favorite Market Indicator. Market Cap to GDP is a valuation indicator that has been popularized by Warren Buffett who claimed back in 2001 that it is probably the best single measure of where valuations stand at any given moment Apparently Warren Buffett thinks that the combined value of all stocks as measured by the Wilshire 5000 Total.

The Buffett Indicator currently is at its most extreme bearish level in US. This ratio now commonly known as the Buffett Indicator compares the size of the stock market to that of the economy. The indicators we use are still the percentages of the total market caps of these countries over their own GDPs and the modified indicator TMC GDP Total Assets of Central Bank ratio.

The Buffett Indicator The Buffett Indicator is a simple ratio. From there the Buffett Indicator took off jumping to 122 in 2019 147 in 2020 and as of mid-day on April 5 with the SP hovering at a record 4071 156 based on the. Buffett later walked back those comments hesitating to endorse any single measure as either comprehensive or consistent over time but this ratio remains credited to his.

The Buffett Indicator is the ratio of total US stock market valuation to GDP. Joey Frenette February 16 2021. Among the many principles that Warren Buffett has espoused his Buffett Indicator is one of the most important.

GNP is probably the best single measure of where valuations stand at any given. 22 2021 at 815 am.

Warren Buffett S Favorite Valuation Metric Is Ringing An Alarm Bloomberg

Warren Buffett S Favorite Valuation Metric Is Ringing An Alarm Bloomberg

Market Cap To Gdp An Updated Look At The Buffett Valuation Indicator Dshort Advisor Perspectives

Market Cap To Gdp An Updated Look At The Buffett Valuation Indicator Dshort Advisor Perspectives

The Buffett Indicator At All Time Highs Is This Cause For Concern

The Buffett Indicator At All Time Highs Is This Cause For Concern

The Buffett Indicator At All Time Highs Is This Cause For Concern

The Buffett Indicator At All Time Highs Is This Cause For Concern

This Favorite Warren Buffett Metric Tells Us A Stock Market Crash Could Be Coming The Motley Fool

This Favorite Warren Buffett Metric Tells Us A Stock Market Crash Could Be Coming The Motley Fool

What Is The Warren Buffett Indicator Vintage Value Investing

What Is The Warren Buffett Indicator Vintage Value Investing

The Buffett Indicator At All Time Highs Is This Cause For Concern

The Buffett Indicator At All Time Highs Is This Cause For Concern

Warren Buffett Stock Market Indicator

Buffett Indicator Why Investors Are Walking Into A Trap Seeking Alpha

Buffett Indicator Why Investors Are Walking Into A Trap Seeking Alpha

The Ultra Flawed Buffett Indicator Seeking Alpha

The Ultra Flawed Buffett Indicator Seeking Alpha

Comments

Post a Comment