- Get link

- X

- Other Apps

Have a separate business bank account. But given that Lendio works with more than 75 lenders including some we recommend below theres a good chance youll find some kind of funding for your startup.

We Provide Quick Loans For Business Business Loans Quick Loans Small Business Loans

We Provide Quick Loans For Business Business Loans Quick Loans Small Business Loans

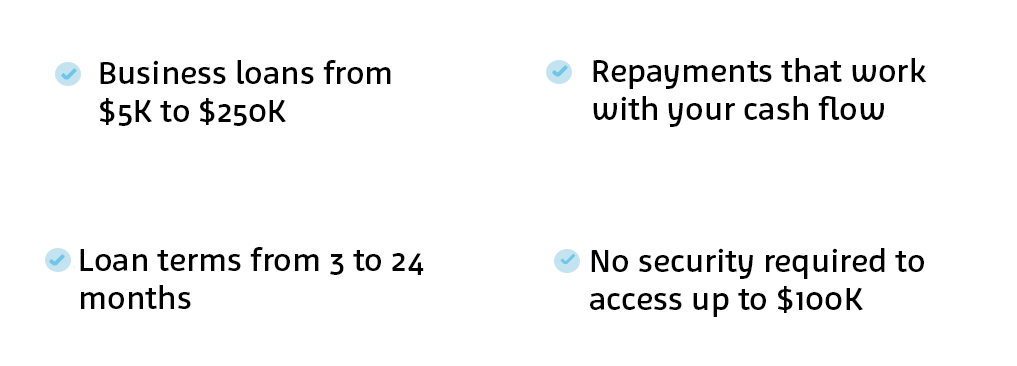

A term loan means you borrow a one-time lump sum of cash and pay it back over a fixed period of time or a term Our short-term loans range in term length giving you flexibility around repayment.

Small business loans 3 months in business. Compare small-business loans from online lenders including term loans SBA loans and lines of credit. Compare your options with trusted advice. Small business loans can be secured or unsecured and more often than not charge interest at a fixed rate over terms up to around 60 months 5 years.

Fundera connects small business owners to the best loan option for them through our online marketplace of vetted business lenders. Annual percentage rates for this type of loan usually range between 85 and 80. 51 of business ownership to sign.

This type of loan often comes with three- to 18-month terms and requires daily or weekly payments. Small business owners can crowdfund business loans from philanthropic-minded individuals up to 15000. Required to qualify or pre-qualify.

Read more about short term business loans. These loans carry a 0 APR and are provided to struggling entrepreneurs who have proven their character invited their own network of lenders were unable to access other financial means and have a business that has a perceived positive social impact. Business owners in search of smaller loans can find funding with the SBA Microloans program which offers loans between 3000 and 50000.

3 months in business for starter terms. 8000 per month minimum monthly deposits. Beginning April 6 small businesses and non-profits can apply for up to 24 months of relief with a maximum loan amount of 500000 the Small Business.

Business loans are available in both revolving credit and instalment loans. Heres a guide to get a business loan after three months in business. Generally speaking short-term business loans typically have maturities ranging from three months to three years with most short-term loans between three and 18 months.

Due to their relatively high cost are best for managing one-time expenses. Fundbox 3 months in business with a minimum annual revenue of 50000 and no minimum credit requirements. Do you need a business loan to purchase new equipment or for working capital.

Fundera features leaders in every financial category so you can rest assured that youre accessing. Apply for Small Business Loans in less than 60 seconds. Amounts range up to 100000 and they also offer invoice financing as well as terms loans and lines of credit.

3 Months of P. Why Do You Need A Business Loan. 90 Loan Approval Rate.

Now meeting those bare minimum qualifications wont get you the lowest rates or biggest loans. And sure enough BlueVine has relatively lax application requirementsjust 120000 in annual revenue three months in business and a 530 credit score. With one simple application you can see all the products and lenders you qualify for and start evaluating which small business loan is best for your business.

When you need ongoing quick access to working capitalsay for managing cash flowan OnDeck Line of Credit LOC is the way to go. In addition the borrower does not need to apply for this relief as it will be automatically applied to for. Rates and terms vary by loan type but small business loans typically have terms from three months to 60 months and require a business bank account for funding.

Check out this list. Provide the most recent 3 months business checking account statements. Signed and dated application for at least 50 of ownership.

Similar to business grants if more traditional small business startup loans arent available to you another option is to turn to friends and family to raise initial funds. If your industry is prone to seasonal variations this is one scenario that could lead you to consider a short-term business loan. Of course you probably wont qualify for that full 5 million with just the bare minimum qualifications.

Maximum NSF 5 per month or 10 in 3 months. You can apply online or with a representative over the phone and get a quote within a few minutes. To qualify for a Lendio loan youll need to have been in business for six months and have at least a 550 credit score.

For all new SBA loans approved after February 1 2021 the SBA will make three payments of principal and interest on the loan paid to the lender on the borrowers behalf. Maximum Negative balance days 5 per month or 10 in the last 3 months. We will help you find the right loan for your small business.

These include bank loans SBA loans business lines of credit etc. Small Business Funding and our lending partners employ underwriting techniques and processes that provide fast lending decisions in as little as 24 hours or less and funding with 3 days. Find the best interest rates terms amounts.

Our flexible business line of credit is revolving which. If youre looking for a loan with a quick payback time weve researched a variety of lenders to find the best among short-term business loans lines of credit and other financing options. Or if you have received a startup business loan you might work with friends and family to supplement this capital.

To apply for funding you just need to complete our online application and provide 3 months worth of your most recent business bank statements. SBA approved Microloan lenders are often non-profit community-based institutions with experience in lending management and technical assistance for small business owners. Need more options before you choose your small business loan.

These payments are good for all amounts up to 9000 per month. There are loans suited for all your needs a well as lenders. Have at least 5 deposits per month.

The higher the total deposits per month are the more the bank statement loan amount may be. Funding is as quick as the next business day. As you might imagine these loans come with higher rates than say a five-year loan.

Although many successful businesses have been built off the backs of generous friends and family.

Bank Finance Small Business Loans 3 Months Salary Slip Identity Proof Id 22531895662

Bank Finance Small Business Loans 3 Months Salary Slip Identity Proof Id 22531895662

Best Small Business Loans Of 2021 U S News

Best Small Business Loans Of 2021 U S News

The Cares Act Paycheck Protection Program What You Need To Know Wordstream

The Cares Act Paycheck Protection Program What You Need To Know Wordstream

Small Business Loans Accion Opportunity Fund

Small Business Loans Accion Opportunity Fund

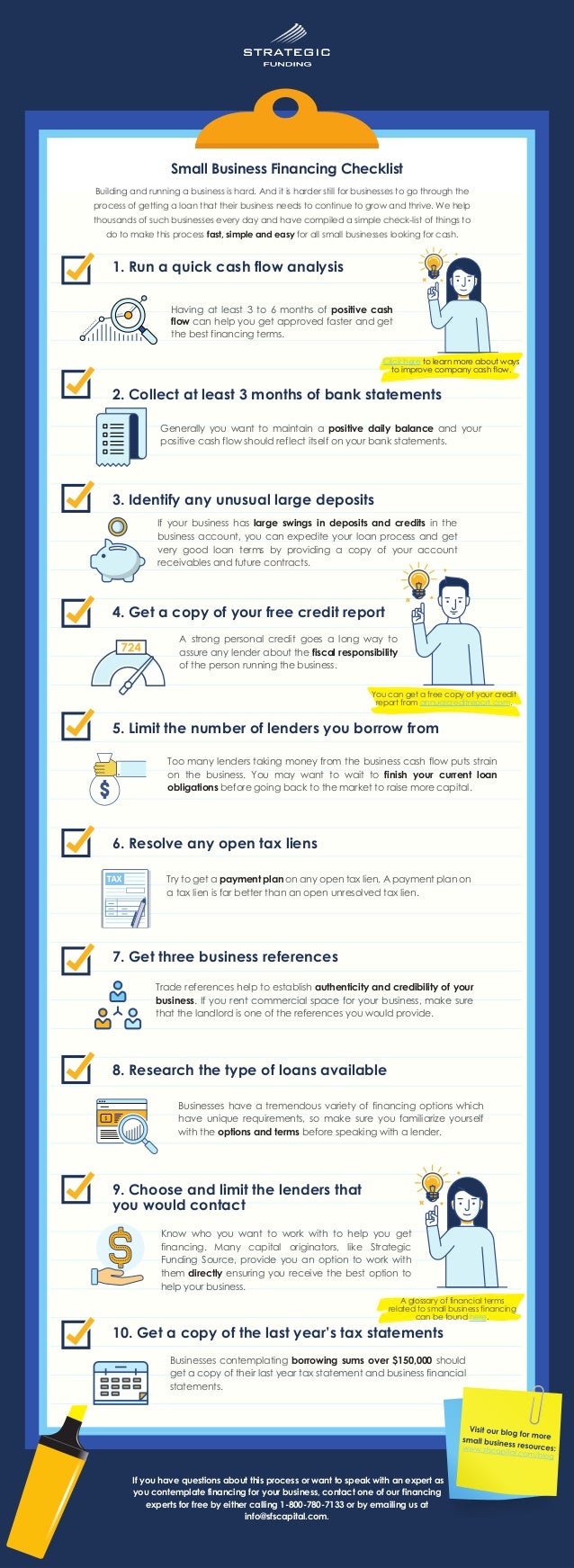

Essential Checklist For Small Business Loans And Alternate Financing

Essential Checklist For Small Business Loans And Alternate Financing

Small Business Loans For Women Providing Opportunities For Women

Small Business Loans For Women Providing Opportunities For Women

Small Business Loans For Android Apk Download

Small Business Loans For Android Apk Download

The 5 Best Small Business Loans Of 2021 Money

The 5 Best Small Business Loans Of 2021 Money

Top Small Business Loans Of 2021 Consumersadvocate Org

Small Business Loans Findon Port Adelaide Mortgage Choice

Small Business Loans Findon Port Adelaide Mortgage Choice

![]() Small Business Loans Everything You Need To Know Excel Capital Management

Small Business Loans Everything You Need To Know Excel Capital Management

![]() Fast Business Loans Free Quotes Same Day Funding

Fast Business Loans Free Quotes Same Day Funding

Comments

Post a Comment