- Get link

- X

- Other Apps

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. What Is Tax Forgiveness.

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

What Is The IRS Tax Debt Forgiveness Program.

Tax forgiveness program irs. The IRS has expanded their Fresh Start initiative which makes it easier to afford your tax payments with IRS debt forgiveness. Some forms of tax forgiveness allow taxpayers to pay off their debt in installments while others either lower the debt or clear it. A payment program providing easier alternatives for taxpayers fraught with taxes and debts beyond their means.

Under certain circumstances taxpayers can have their tax. But the person has to get professional assistance to get the forgiveness. There is a lot of talk online about the IRS Tax Debt Forgiveness Program You may be surprised to know that the IRS does not have an official Debt Forgiveness Program However there are other programs and initiatives the IRS has launched.

The IRS Debt Relief Program Debt Forgiveness Program is a type of arrangement for taxpayers with unpaid taxes. The IRS fresh start initiative allows for forgiveness credits against your earned income to reduce the overall amount owed in some cases down to zero. The IRS announced last week that taxpayers who received excess advance payments in 2020 on the tax credit for health care under the Affordable Care Act arent required to file Form 8962 Premium Tax Credit or report an excess advance Premium Tax Credit repayment on their Form 1040 or Form 1040-SR Schedule 2 Line 2 when they file their 2020 taxes this.

While some illusions are simply harmless distractions trusting tax forgiveness fantasies can unravel the very fabric of your existence. The bad news is that there is not a singular debt forgiveness program. Ignoring tax debt wont cause the IRS to realize a taxpayer doesnt.

Your debt may be fully forgiven if you can prove hardship that qualifies you for Currently Non Collectible status. Why would the IRS allow you to receive forgiveness for money that you owe them. The circumstances surrounding the unpaid debts will get thoroughly examined by the professionals.

Whether you choose to handle the IRS Tax Debt Forgiveness process on your own or you choose to pay for assistance of an IRS Tax Debt Settlement company my site was created to help you understand your tax issues so that you could make more informed decisions about how best to proceed in dealing with your IRS tax debt. IRS Tax Debt Forgiveness Whether you owe the IRS thousands or tens of thousands of dollars in back taxes youre likely to be eligible for some sort of tax forgiveness program. The short-term payment plans are now able to be extended from 120 to 180 days for certain taxpayers.

Usually its in a taxpayers best interest to seek a forgiveness program if they believe they owe several thousand in back taxes and cannot make the monthly minimum payments on an installment agreement also known as a payment plan. Tax forgiveness means that the IRS has agreed to an arrangement to help an individual get out of tax debt. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

Its simple really its illegal for the IRS to collect money from someone who literally. We consider your unique set of facts and circumstances. IRS Tax Debt Forgiveness Program Definition.

Beginning in 2011 the IRS launched the Fresh Start program. What Is The IRS Debt Forgiveness Program. In that case weve got good news and bad news.

It may be a legitimate option if you cant pay your full tax liability or doing so creates a financial hardship. True tax forgiveness comes in the form of credits against the tax debt. Oftentimes the worse your financial outlook the more tax forgiveness youll be offered.

It will make a person qualify for IRS Tax Debt Relief Program. Tax forgiveness while ideal in concept is not a tangible solution for your liability. In order to find out if youre eligible for the IRS debt forgiveness program your case needs to be examined.

In general this service is available to individuals who owe 50000 or less in combined income tax penalties and interest or businesses that owe 25000 or less combined that have filed all tax returns. If youre reading this then you want to learn about the IRS debt forgiveness program. This might sound dramatic but if youve ever gone head to head with the IRS you know the hyperbole is apt.

This includes being able to pay in increments or coming to a compromise with the IRS among others. August 23 2019. Why Should You Apply for an IRS Tax Forgiveness Program.

There is no actual Program called IRS Tax Forgiveness but there are a series of different ways to write-down or write-off some of your unpaid back taxes. The good news is that there are actually several IRS programs to help you achieve tax forgiveness. It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with owing tax debt.

Even the IRS understands life happens. These credits can reduce some or all of your tax liability. You can also apply for the IRS debt forgiveness program if youre self-employed and have experienced at least a 25 loss of income.

Thats why the government offers IRS debt forgiveness when you cant afford to pay your tax debt. What Is the Fresh Start Program With the IRS.

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Three Ways To Settle Or Resolve Your Tax Debt Advance Tax Relief By Noah Daniels Ea Issuu

Three Ways To Settle Or Resolve Your Tax Debt Advance Tax Relief By Noah Daniels Ea Issuu

What Is Irs Tax Debt Relief Program Do You Qualify For It

What Is Irs Tax Debt Relief Program Do You Qualify For It

What Is The Irs Debt Forgiveness Program

What Is The Irs Debt Forgiveness Program

2020 Guide To The Irs Tax Debt Forgiveness Program Forget Tax Debt

2020 Guide To The Irs Tax Debt Forgiveness Program Forget Tax Debt

Amazon Com Owe 10k More Or Less To The Irs In Taxes Owe 10k Or More To Irs How To Permanently Solve Your Irs Stop Collection Activity The Taxman Irs Off Your Back

Amazon Com Owe 10k More Or Less To The Irs In Taxes Owe 10k Or More To Irs How To Permanently Solve Your Irs Stop Collection Activity The Taxman Irs Off Your Back

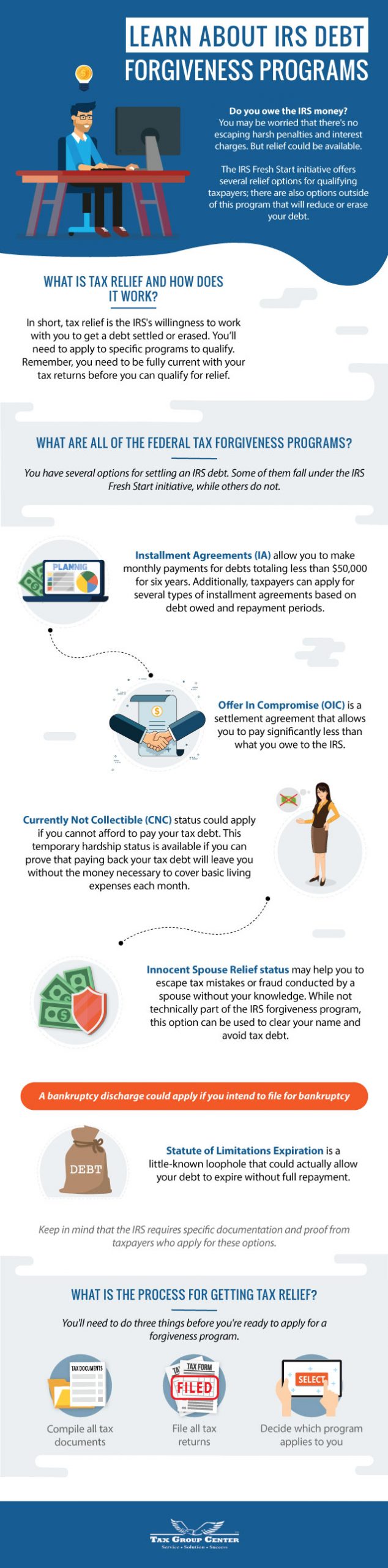

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Everything You Need To Know About Irs Tax Forgiveness Programs

Everything You Need To Know About Irs Tax Forgiveness Programs

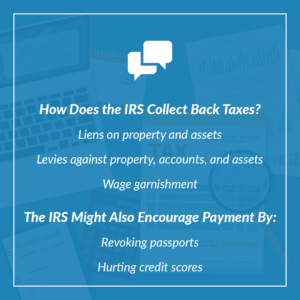

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program The W Tax Group

What Is The Irs Debt Forgiveness Program The W Tax Group

What Is The Irs Tax Debt Forgiveness Program Irs Debt Forgiveness Help

What Is The Irs Tax Debt Forgiveness Program Irs Debt Forgiveness Help

Irs Debt Forgiveness Program Tax Group Center

Irs Debt Forgiveness Program Tax Group Center

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center Debt Forgiveness Debt Tax Debt

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center Debt Forgiveness Debt Tax Debt

Comments

Post a Comment