- Get link

- X

- Other Apps

The Vanguard Intermediate-Term Bond ETF BIV holds US government debt and similar types of high-quality fixed income. The municipal market totals 38 trillion in debt outstanding according to this report from SIFMA.

Is 4 Trillion At Risk In Bond Funds Seeking Alpha

Is 4 Trillion At Risk In Bond Funds Seeking Alpha

Premium Members can use our Premium.

Safest municipal bond funds. News rankings of top-rated Municipal Bond mutual funds. However when an investor holds single bond securities the investor has control over the selection of the securities and the timing of purchase and sale. Bond funds never truly mature as do individual bond holdings.

Treasuries municipal bonds corporate bonds or foreign government and corporate bonds. With MUBs 179 billion in assets under management municipal bond investors have. Bond Index also is one of the best bond funds for investors pinching pennies.

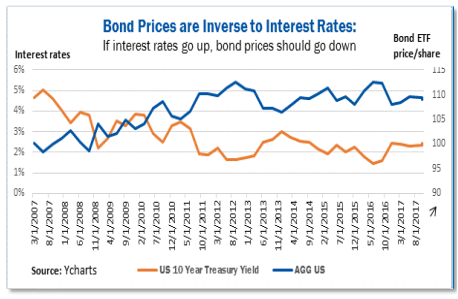

You can buy individual municipal bond funds or purchase municipal bond funds that contain a collection of different muni bonds. Falling interest rates and the appeal of. Bond funds invest in fixed securitiesthese can take the form of US.

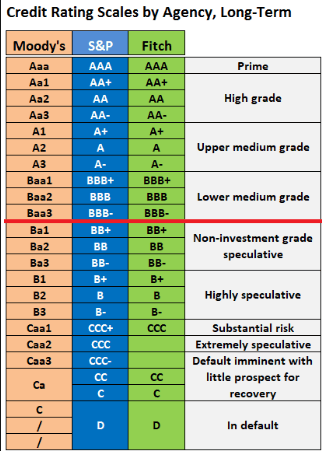

Safe Investments Municipal bonds are very safe animals at least those rated by the major rating agencies such as Moodys which are the vast majority of munis. These bond funds all earn our highest rating--a Morningstar Fund Analyst Rating of Gold--as of this writing. While municipal bonds tend to offer lower yields than other types of bonds you will generally not have to pay federal taxes or possibly state and local taxes on them making the after-tax return attractive particularly for investors.

FXNAX which can be productive in almost any economic and interest-rate environment charges a mere. Municipal bonds or muni bonds are issued by municipalities such as states counties and local governments to finance projects for public services. Its a big liquid fund that yields 24 like AGG and gradually grinds.

These state and local bonds have a historically low chance of defaulting and most of them are tax-free so unlike corporate bonds investors dont have to pay taxes on. Use the comprehensive ranking lists by category to compare funds and find the best investment for you. How Bond Funds Are Different Than Bonds.

IShares National Muni Bond ETF is a low-cost index fund that gives you broad exposure to muni bonds from across the US. Are Municipal-Bonds Always a Safe Haven. Bond funds work differently from bonds because mutual funds consist of dozens or hundreds of holdings and bond fund managers are buying and selling the underlying bonds held in the fund.

Theyre great starting points for your research. Tax-free municipal bond funds are a path to higher returns and lower taxes. Municipal bonds or munis are debt instruments issued by states municipalities.

These entities issue bonds to raise capital money for the purpose of funding projects or to fund internal and ongoing operations. It seeks to track the investment results of the SP National AMT-Free. Holding an individual bond.

When Munis Outside Your State Make Sense. Municipal bonds bonds issued by governments and agencies often to finance projects like airports schools and infrastructure have long been considered a low-risk source of retirement income. Municipal bond exchange-traded funds ETFs provide investors with diversified access to the municipal bond market.

This national municipal bond fund is one of the most popular with access to more than 2000 US. This market hasnt been immune to trouble stemming from the coronavirus-related volatility.

Bond Investing For Dummies Door Russell Wild Managementboek Nl

Bond Investing For Dummies Door Russell Wild Managementboek Nl

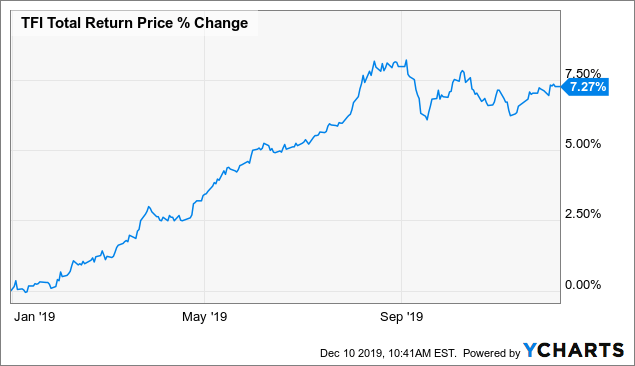

Closed End Fund Muni Market Update December Yields Up To 4 85 Tax Free Seeking Alpha

Closed End Fund Muni Market Update December Yields Up To 4 85 Tax Free Seeking Alpha

Miller Tabak Asset Management Llc In The News

Best Mutual Funds Awards 2020 Best Muncipal Bond Funds Investor S Business Daily

Best Mutual Funds Awards 2020 Best Muncipal Bond Funds Investor S Business Daily

Should You Consider Muni Bonds

Should You Consider Muni Bonds

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

Municipal Bond Investing In The Covid 19 Era Seeking Alpha

Municipal Bond Investing In The Covid 19 Era Seeking Alpha

What Are Municipal Bonds Pros Cons Of Investing

What Are Municipal Bonds Pros Cons Of Investing

/municipal-bonds-what-are-they-and-how-do-they-work-3305607-FINAL-75578b195af448588b93a7fced720a97.png) Municipal Bonds Definition How They Work Threats

Municipal Bonds Definition How They Work Threats

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

Are Municipal Bonds A Safe Source Of Retirement Income Now Money

How Is The Coronavirus Crisis Affecting The Municipal Bond Market Econofact

How Is The Coronavirus Crisis Affecting The Municipal Bond Market Econofact

The Best Municipal Bond Funds Morningstar

The Best Municipal Bond Funds Morningstar

Closed End Funds 4 Municipal Bond Funds For Your Portfolio Seeking Alpha

Closed End Funds 4 Municipal Bond Funds For Your Portfolio Seeking Alpha

Comments

Post a Comment