- Get link

- X

- Other Apps

Two investors who say they have been making big money shorting Chinese stocks listed in the United States fronted up to their adversaries this week -- in a mood to swagger. The FTSE China 25 Index ETF FXI is.

Wall Street Makes New Bid For Easier Shorting Of Chinese Stocks Bnn Bloomberg

While short selling is legal for onshore traders in China curbs were imposed after the crash of 2015 that authorities blamed on short sellers and currently only the shares of large companies are.

Shorting chinese stocks. It involves borrowing and selling shares then buying them back later at a lower price and returning them while pocketing the difference. Chinas stock market gets a reality check Chinese brokerages have stopped executing short sales after officials tightened trading rules in a new attempt to shore up the countrys stock market. The bubble in Chinese stocks is bursting and there is nowhere to go but down.

Starting in 2007 the Chinese government in an effort to increase the types of financial instruments available to market. The level of magnification is included in their descriptions and are generally -1x -2x or -3x. By Kris Gunnars BSc March 30 2020 Shorting also called short selling is a way to bet against a stock.

InverseShort China ETFs seek to provide the opposite daily or monthly return of various broad indexes tied to Chinese stocks. The funds use futures and can also be leveraged. Typically shorting China stocks is both expensive and fraught.

This essentially creates a short position in Chinese stocks. That is the common refrain echoed throughout the financial media in recent weeks ever since China. This article will discuss the various ways to short China using ETFs.

So far Chanos has proved correct in his bearish stance on China. Stocks with Chinese exposure designed to closely mirror the performance of. Although W stock is up 144 year to date its lost 282 over the past three months as investors came to realize that the tariffs imposed on Chinese goods imported into.

Stocks like Deere Company NYSE. If the stock goes down the trader makes a profit but there are several major risks involved. BA are obvious short targets but they have already have sold off and perhaps too far.

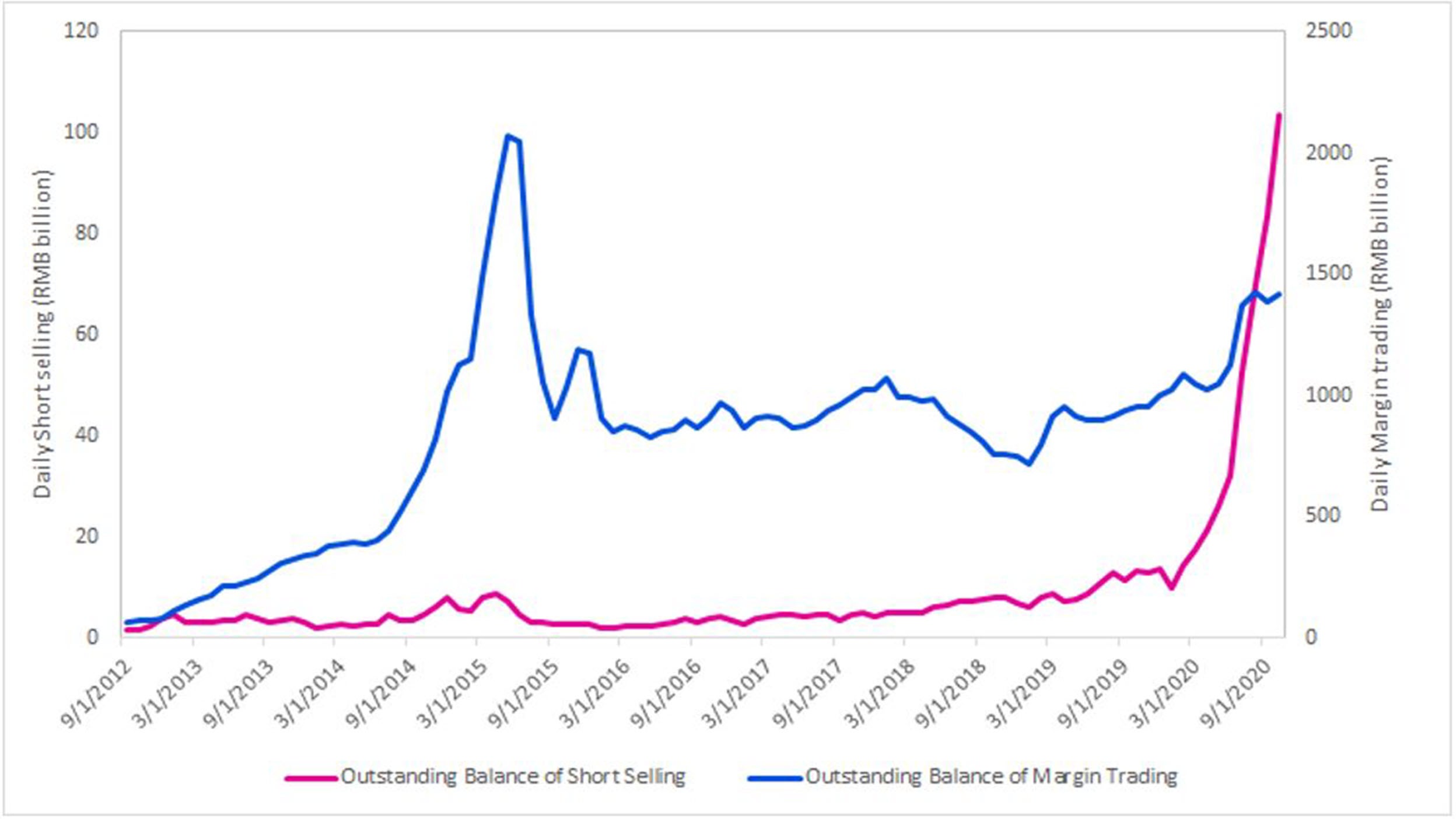

The outstanding balance of shorted stocks on the Shanghai and Shenzhen exchanges rose to 762 billion yuan US112 billion on July 25 the highest level since June 2015 but still a tiny fraction. The best way for investors to go short China is by using ETFs. CAT and Boeing Co NYSE.

Famed short-seller Andrew Left is aggressively shorting a crazy stupid Chinese stock that has gained more than 320 on the New York Stock exchange in 2020 as he believes it has exaggerated its. And that can make it easy to find Chinese stocks that you can sell short in your native currency. Second FXP shorts only the FTSEXinhua China 25 index which as it says is only 25 stocks.

Plus there are plenty of Chinese stocks listed on American exchanges. The best way of shorting the Chinese stock market might be to focus on the weakest or most over-valued Chinese stocks. Meanwhile investors are also expressing their concern by shorting Chinese exchange-traded funds and companies with listings in US markets.

Morgan Stanley released on April 13 an analysis of Chinese stocks listed in the US. An effective though risky way to short the China market is to take short positions in ETFs that are long on Chinese stocks. It is important to note that there is absolutely no way of shorting mainland-listed shares.

But the synthetic short - a basket of about 40 US. The Chinese stock market has a very limited history of short sales. And Hong Kong that have seen the greatest increase in short.

A Famed Short Seller Explains Why He S Betting Big Against A Chinese Tech Stock That Has Seen A Crazy Stupid 320 Gain In 2020 Markets Insider

China S Better Than Tesla Stock Is A Scam Short Sellers Say

China S Better Than Tesla Stock Is A Scam Short Sellers Say

Short Selling How Tiny Activist Firms Became The Sheriffs In The Stock Market S Wild West Fortune

Short Selling How Tiny Activist Firms Became The Sheriffs In The Stock Market S Wild West Fortune

China Explained Series How Margin Trading And Short Selling Work In China

China Explained Series How Margin Trading And Short Selling Work In China

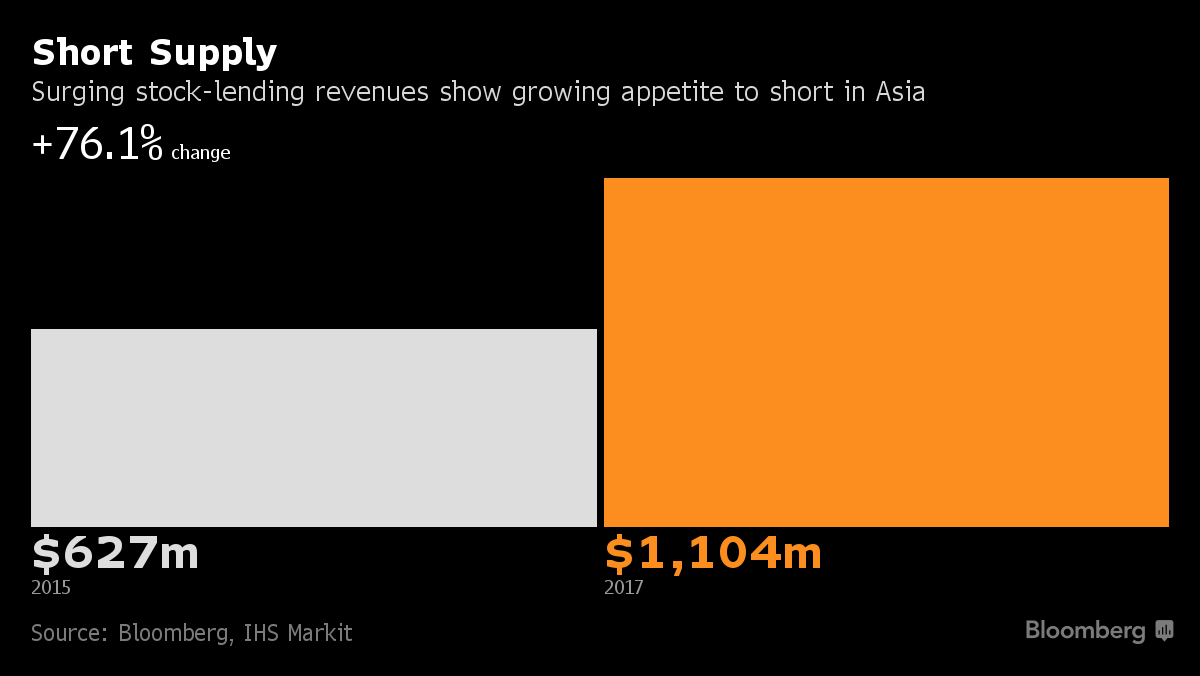

Msci Inclusion May Lower Barriers To Shorting Chinese Stocks Wealth Investing The Business Times

Msci Inclusion May Lower Barriers To Shorting Chinese Stocks Wealth Investing The Business Times

:max_bytes(150000):strip_icc()/unnamed-2-9673f947ad9645d9b82d36b6dc2c274c.jpg) Short Sellers Are Buying Positions In Chinese Stocks Amid Coronavirus

Short Sellers Are Buying Positions In Chinese Stocks Amid Coronavirus

Coronavirus And The Case For Shorting China Exposed South African Stocks

Coronavirus And The Case For Shorting China Exposed South African Stocks

After Luckin Short Selling Spree What S Next For Chinese Stocks

After Luckin Short Selling Spree What S Next For Chinese Stocks

Morgan Stanley Names Chinese Stocks Investors Are Shorting Includes Evs

Morgan Stanley Names Chinese Stocks Investors Are Shorting Includes Evs

Shorting China Stocks From New York Could Get Easier Bloomberg

Shorting China Stocks From New York Could Get Easier Bloomberg

China Markets Short Selling Tests China S Zeal For Market Reform The Economic Times

China Markets Short Selling Tests China S Zeal For Market Reform The Economic Times

Comments

Post a Comment