- Get link

- X

- Other Apps

The median FICO Score. Most widely used.

Fico Score Meaning 5 Things You Need To Know Badcredit Org

Fico Score Meaning 5 Things You Need To Know Badcredit Org

FICO 8 Auto and FICO 8 Bankcard.

What is fico score 8 used for. Do mortgage lenders use FICO Score 8 from all three credit bureaus or FICO Score 8 from one and FICO Score. Youve pulled your FICO Scores and credit reports at myFICO to see where you stand but are not sure on which FICO Score versions you should focus. If the late payment is an isolated event and other accounts are.

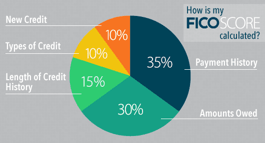

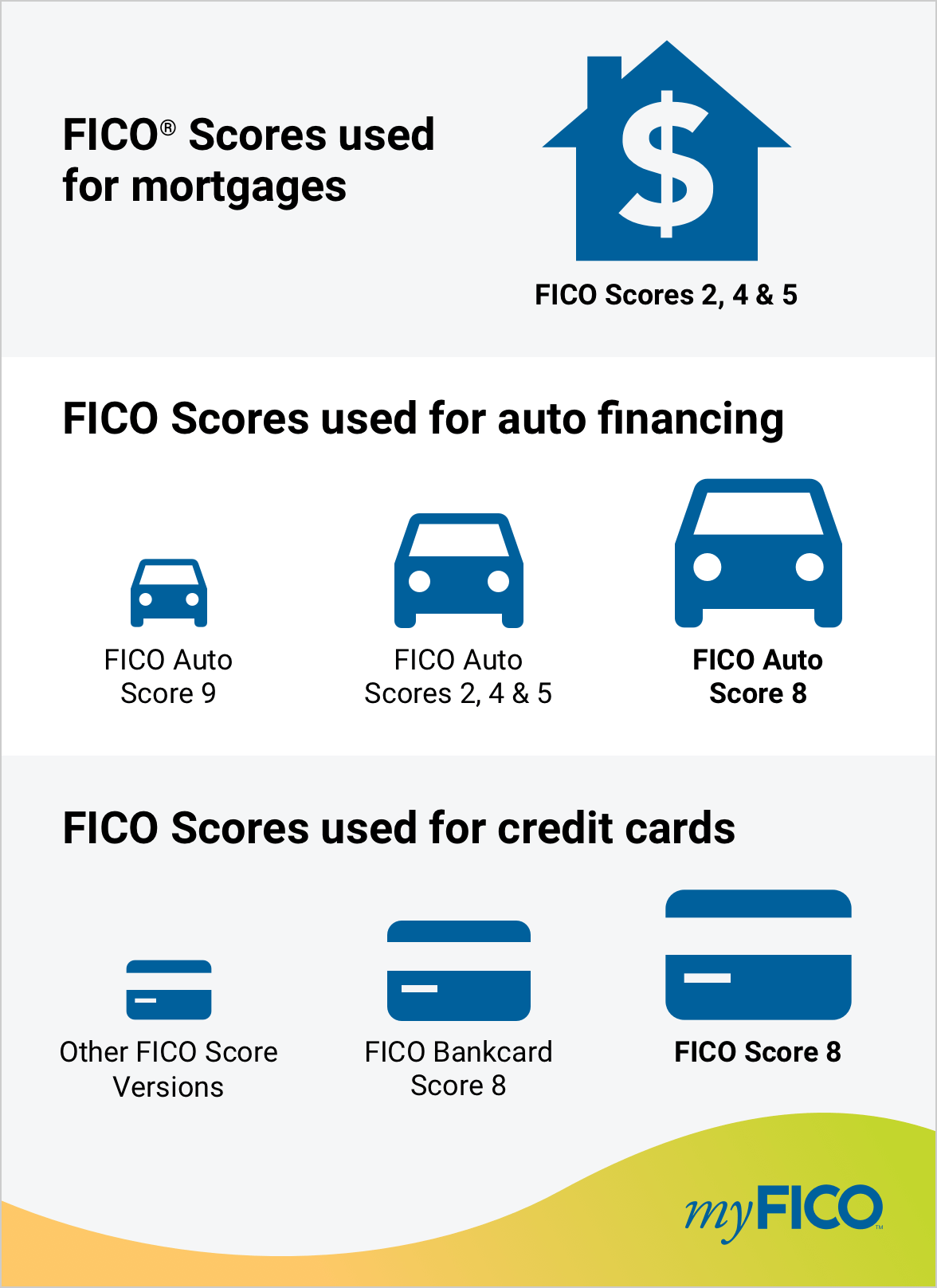

The new score offers what the company characterized as a more nuanced way to assess debt collection related to medical bills by differentiating medical from non-medical collection agency accounts. An industry standard since they were first introduced over 30 years ago FICO Scores are used by 90 of top lenders. 5 Zeilen In general if youre trying to get a new credit card car loan or consumer loan then your.

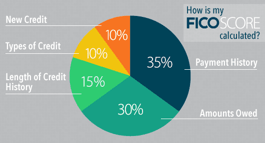

FICO Score 8 and 9. FICO Auto Scores 2 4 5 and 8. The FICO 8 model is known for being more critical of high balances on revolving credit lines.

There are two sub-versions of the FICO 8 score. FICO Auto Scores. This will help ensure that medical collections have a lower impact on the score commensurate with the credit risk they represent FICO explained in a statement.

2 Finally depending on the type of credit requested lenders. FICO Bankcard Scores 2 4 5 and 8. This version can also be used in auto lending as well as for personal loan and credit card decisions.

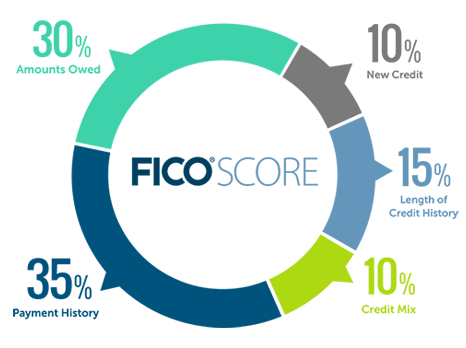

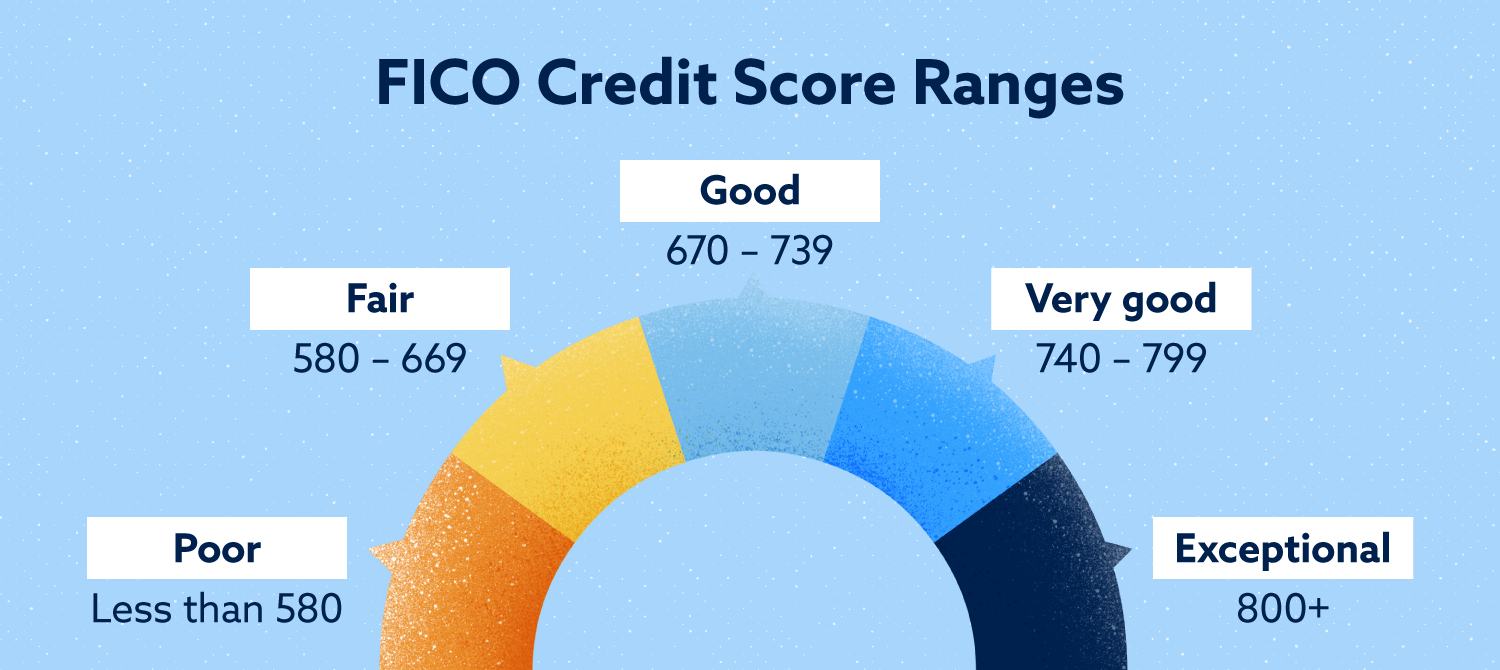

Your FICO scores which typically range from 300 to 850 could affect whether your credit application gets accepted and the terms and rates youre offered. It pays more attention to high-use credit cards. FICO Scores 2 4 and 5.

FICO Scores are the most widely used credit scores. FICO 8 is more lenient to isolated late payments. A number of lenders have switched to FICO 9 which is more forgiving of unpaid medical bills but FICO 8 remains the most widely used.

Capital One might let you in with their starter Platinum with toy SL of 1K-3K but they pull all 3 CRAs therefore consuming all your 3 HPs allotment. Also most Credit Unions uses EQ FICO 89. For other types of credit such as personal loans student loans and retail credit youll likely want to know your FICO Score 8 which is the score most widely used by lenders.

Fair Isaac Corporation or FICO creates a variety of credit scores for use by lenders credit card issuers and other creditors. Since FICO 8 Bankcard Score is specifically designed for credit card lenders it uses credit criteria more conducive to that type of lending. FICO 8 is the most widely used version of the standard model used to score consumers on their use of credit.

Currently the most common FICO score is FICO 8. FICO 8 also treats isolated late payments more judiciously than past versions. Refinancing or taking on a new mortgage.

FICO Score 8 is a base score meaning it is used to consider the risk of a borrower not making payments on any type of loan. Other types of FICO Score are used for a specific type of borrowing such as an auto loan. Again toy SL as well and 2K if youre lucky.

Although FICO didnt create these models specifically for auto lenders they are widely used credit scores and auto lenders may use a base FICO Score when reviewing auto loan applications. FICO Bankcard Scores or FICO Score 8 are the score versions used by many credit card issuers. As youd expect lenders use FICO 8 Auto to assess creditworthiness for auto loans and FICO 8 Bankcard to assess creditworthiness for new credit card accounts.

These are the latest generic FICO scoring models. Since revolving credit is less of a factor when it comes to mortgages the FICO 2 4 and 5 models. Higher balances even on frequently used and paid cards may have more of a negative impact.

2 The FICO Score 8 model changed from the previous version in several key ways. EQ - Discover half the time uses EQ FICO 8 for apps and half the time EX FICO 8. And you know understanding your FICO Scores is really important as they are the credit scores most commonly used in the mortgage lending process.

For example such a score might put more emphasis on. Youll likely want to know the base FICO Score versions previous to FICO Score 8 as these are the scores used in the majority of mortgage-related credit evaluations. Your credit card issuer can pull your score from any or all three bureaus.

1 The FICO score gets its name from the Fair Isaac Corporation now called FICO the. FICO 8 is more sensitive to highly-used credit cards.

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico

How Fico Score 9 Is Different From Fico Score 8 To Boost Credit Rating

How Fico Score 9 Is Different From Fico Score 8 To Boost Credit Rating

/Balance_The_Fico_8_Credit_Scoring_Formula-1203b3ec26b34cc4aa2eddbee3a8bdb1.png) Fico 8 Credit Score What Is It

Fico 8 Credit Score What Is It

How Many Credit Scores Do You Have

How Many Credit Scores Do You Have

How I Got My Credit Score To An All Time High

How I Got My Credit Score To An All Time High

What Is The Average Credit Score In America Credit Com

What Is The Average Credit Score In America Credit Com

What Is A Good Fico Score Vanderbilt Mortgage And Finance Inc

What Is A Good Fico Score Vanderbilt Mortgage And Finance Inc

How Are Fico Scores Calculated Myfico Myfico

How Are Fico Scores Calculated Myfico Myfico

What Credit Score Do You Need To Buy A Car

What Credit Score Do You Need To Buy A Car

What Is A Good Credit Score Experian

What Is A Good Credit Score Experian

Understanding Your Credit Score What S The Difference Between Your Fico Scores Money Under 30

Understanding Your Credit Score What S The Difference Between Your Fico Scores Money Under 30

What Is My Fico Credit Score Lexington Law

What Is My Fico Credit Score Lexington Law

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

Comments

Post a Comment