- Get link

- X

- Other Apps

Your employees are not responsible for paying this tax. Paying employees can get complicated.

California Sales Tax Rate Rates Calculator Avalara

If you pay state unemployment taxes you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06.

How much taxes will i pay california. An extra 1 may apply. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. If you earn 10000000 or earn close to it and live in California then this will give you a rough idea of how much you will be paying in taxes on an annual basis.

In 2012 Californias Proposition 55 placed a temporary extension through 2030 on a 133 tax rate on Californias high-income earners. Taxes in California Income tax. In 2019 the SDI rate is 1.

For the calculation we will be basing all of our steps on the idea that the individual filing their taxes has a salary of 10000000. TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. Your gain is usually the difference between what you paid for your home and the sale amount.

This California bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. 073 average effective rate Gas tax. How much you owe will depend on how much income you collected last year -- from unemployment W2 employment freelancing investments etc.

Using our California Salary Tax Calculator. That means that your net pay will be 42930 per year or 3577 per month. California state tax rates are 1 2 4 6 8 93 103 113 123.

-- and what tax bracket you fall under based on that income. You will need to pay 6 of the first 7000 of taxable income for each employee per year. Work out your gain.

Its not as simple as taking their annual salary and dividing it by a set number of pay periodsyou have to withhold the appropriate amount of taxes from employee paychecks pay your own payroll taxes and follow numerous paycheck rules. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Heres who must pay California state tax whats taxable.

Advertentie Free For Simple Tax Returns Only With TurboTax Free Edition. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum. Heres what you need to know about California payroll taxes and.

Check the withholding schedule or use a payroll service to determine how much tax to. California personal income tax. FUTA tax is the sole responsibility of the employer.

Get Your Max Refund Today. 1 - 133 Sales tax. To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Census Bureau Number of cities that have local income taxes. What to know about California paychecks and taxes. Any gain over 500000 is taxable.

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. The top individual income tax rate in California is 123 on annual incomes over 599012 for single taxpayers and married or RDP taxpayers who file separate returns. Get Your Max Refund Today.

California Paycheck Calculator California income tax rate. Your average tax rate is 220 and your marginal tax rate is 397. Use Selling Your Home IRS Publication 523 to.

After a few seconds you will be provided with a full breakdown of the tax you are paying. 725 - 1050 Property tax. The 123 threshold for married and RDP partners filing jointly is 1198024 and its 814658 for head of household filers.

If you make 55000 a year living in the region of California USA you will be taxed 12070. Advertentie Free For Simple Tax Returns Only With TurboTax Free Edition. If you do not qualify for the exclusion or choose not to take the exclusion you may owe tax on the gain.

This tax is withheld from employee wages and is based on each employees tax withholding selection on Form W-4 or DE 4. 100 - 1330 Median household income in California.

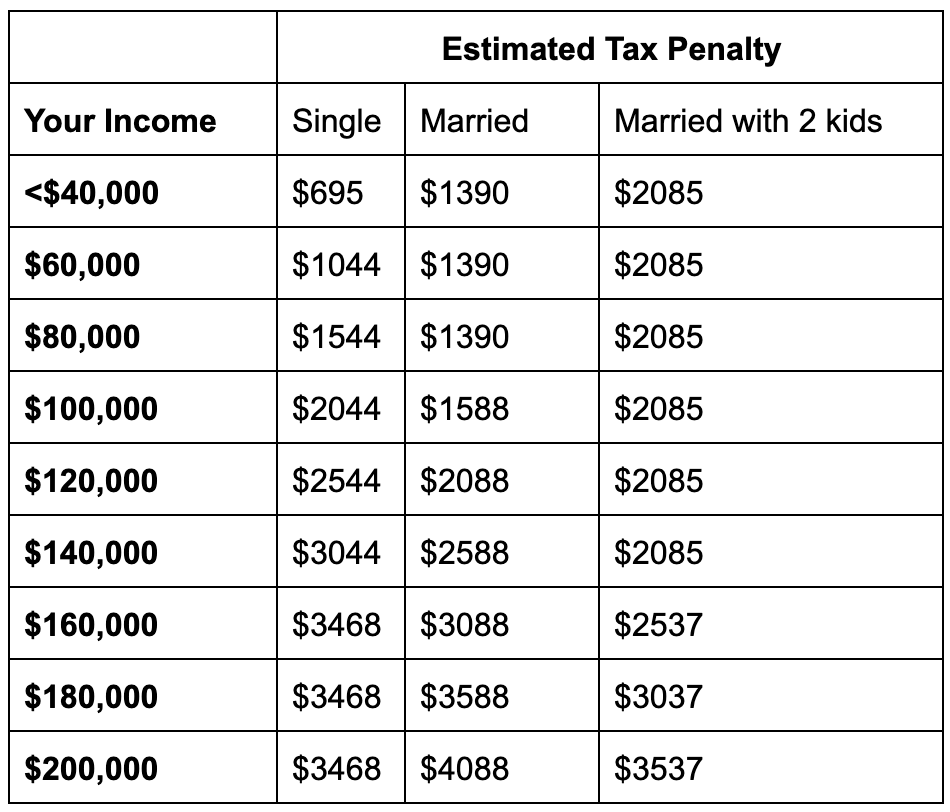

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

California Use Tax Information

California Use Tax Information

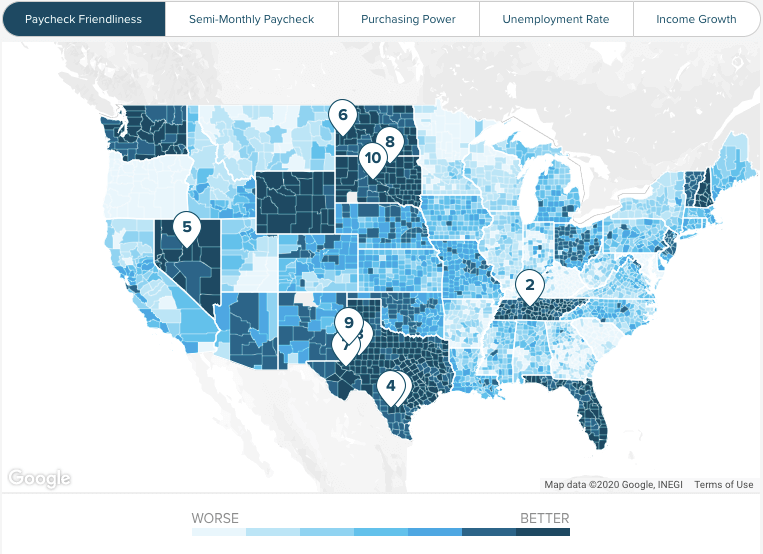

California Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

New Tax Law Take Home Pay Calculator For 75 000 Salary

California Gas Tax What You Actually Pay On Each Gallon Of Gas

California Gas Tax What You Actually Pay On Each Gallon Of Gas

/california-state-taxes-amongst-the-highest-in-the-nation-3193244-final-5e758f0ea2ff48b2b0e2d069756891bb.png) California State Taxes Are Some Of The Highest

California State Taxes Are Some Of The Highest

100 000 A Year Will Make You Go Broke With The California Tax System Why California Is A Fiscal Disaster Broken Tax Structure Built On Bubbles

California Income Tax Calculator Smartasset

California Income Tax Calculator Smartasset

The True Cost To Hire An Employee In California Infographic

The True Cost To Hire An Employee In California Infographic

California Income Tax Calculator Smartasset

California Income Tax Calculator Smartasset

Here S How Much Money You Take Home From A 75 000 Salary

Comments

Post a Comment